You are here: Home1 / Premium

https://chartfreak.com/wp-content/uploads/sites/18/2016/07/rise.jpg

551

901

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2019-11-05 11:46:592019-11-05 11:46:59November 5th – Uptrends

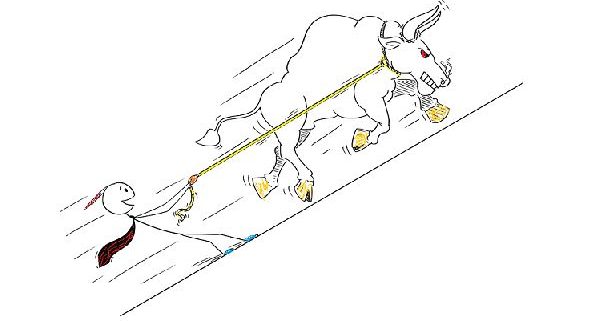

https://chartfreak.com/wp-content/uploads/sites/18/2019/11/BULL-RUN.jpg

572

599

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2019-11-02 19:38:032019-11-02 19:39:14Weekend Report November 2nd

https://chartfreak.com/wp-content/uploads/sites/18/2019/10/SHOPping.jpg

673

899

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2019-11-01 02:47:092019-11-01 02:47:09Friday November 1st

https://chartfreak.com/wp-content/uploads/sites/18/2019/10/FED.jpg

581

621

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2019-10-31 05:37:152019-10-31 05:37:16Oct 31st – Post Fed

https://chartfreak.com/wp-content/uploads/sites/18/2019/10/volatile.jpg

614

684

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2019-10-30 11:15:202019-10-30 11:15:20Another Fed WednesdayIt is a Fed Week and we all know the risks. The biggest risk is not expecting the unexpected. As you will see, the markets are up at or near all time highs. One might wonder, "If the markets are at all time highs and everything is so Bullish and healthy, why would we need another rate cut, since we have already seen cuts recently?" That's a good question, so would a cut be viewed as good? Maybe, Maybe not. Let's examine our markets...

.

Read More

Scroll to top