WEEKEND REVIEW

Let's review what the markets have been doing and what that can mean for this weeks trading.

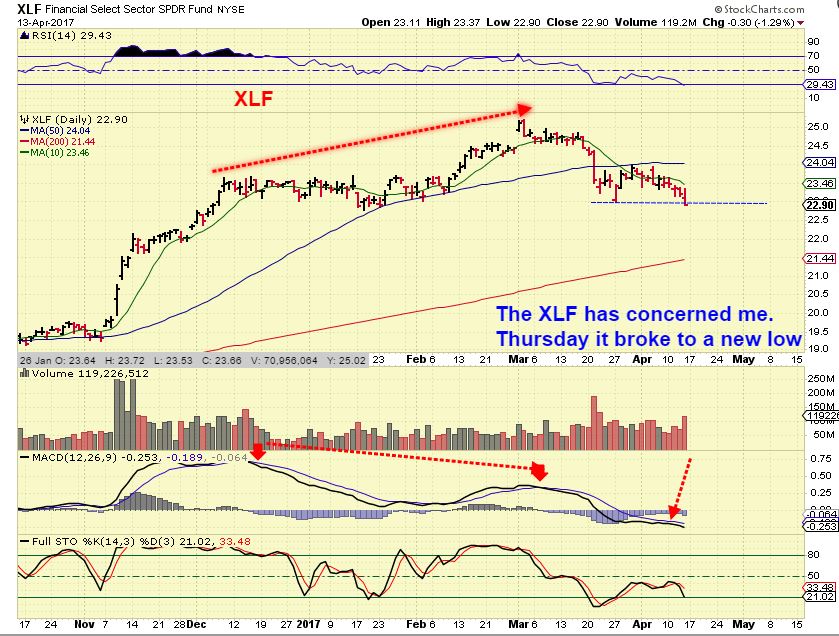

I have repeatedly said that the condition of the financials has concerned me when viewing the markets. Weakness there could bleed over into the general market.