Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

December 5th – Don’t Stay Too Long

December 5, 2017 /130 Comments/in Premium /by Alex - Chart FreakAs mentioned last week, we want to keep some of our open energy trades on a short leash. They were up 20% or so, so after a brief market review, let's take a look, take some profit, and not overstay that welcome 🙂

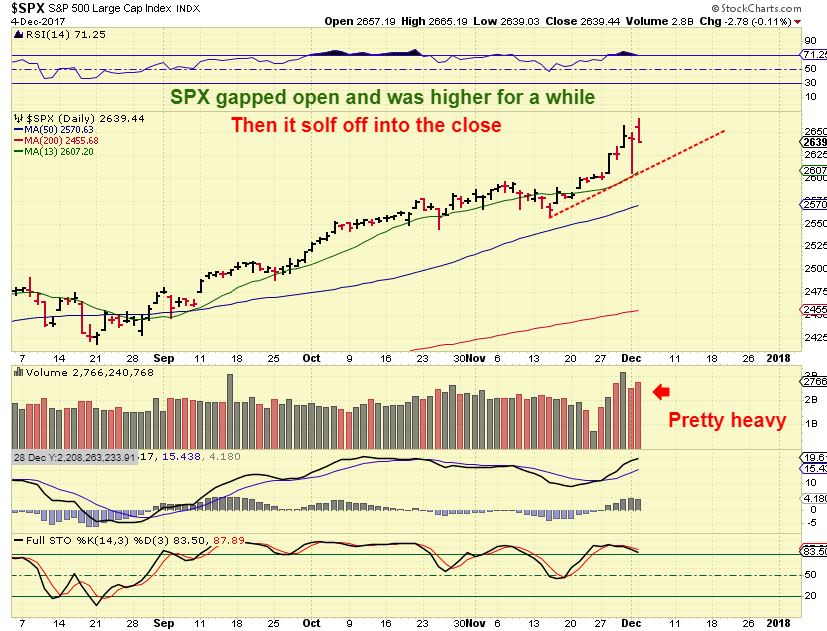

SPX - We saw a large doji candle on Friday ( indecision) and on Monday the markets Gapped open on the hopes that a Tax break will help business, but then it sold off. Am I bearish? No, this is day 12 of a bew daily cycle and the move higher was steep, I think we may just drop to the 10sma & my trend line, or go sideways,,,

Weekend Dec 2

December 2, 2017 /105 Comments/in Premium /by Alex - Chart FreakSPX WEEKLY - Still Bullish? Yes, quite. On a 2 year chart we see that the SPX formed an uptrend channel, and when it got a bit overenthusiastic ( over throw), it immediately sold off and closed back inside. Currently it has closed outside (above) that channel. This can create a steeper incline if it doesn't close back inside next week.

That can lead to more of a parabolic move, and...

Dec 1- Buy Day Friday

December 1, 2017 /117 Comments/in Premium /by Alex - Chart FreakFriday is the last trading day of the week, so let's just look at a couple of the important things and some possible buy opportunities.

Nov 30 – ‘All Together Now’ – Or Not?

November 30, 2017 /150 Comments/in Premium /by Alex - Chart FreakWell, the markets decided not to run together again, so let's take a look at the recent changes.

SPX - The SPX stalled and had a heavy volume doji candle stick. This is often a top or point of indecision...

I want to remind readers of something that I wrote the other day...

Is Bitcoin A Bubble Or Not? Blockchain Part 2

November 29, 2017 in Public /by Alex - Chart FreakMy last public post last week discussed Bitcoin & Blockchain trades. They have been absolutely explosive, some trades running up 300-500% or even more. On Monday (in my premium section) I then went over some of our current trades, and discussed the idea that Bitcoin could go parabolic and then crash down, so caution would be warranted.

Does a parabolic move and crash mean the end of Bitcoin? No it doesn't, so before we get into a debate about whether or not BITCOIN is in a bubble, and whether a 'Bubble' phase means that this is the end of Bitcoin or not, please read on and then see how you feel.

Nov 28- Just The Facts

November 29, 2017 /149 Comments/in Premium /by Alex - Chart FreakSometimes the markets are a bit hazy, and they need to be explained or clarified, but then at other times you can look at the Charts and it just looks like the facts speak for themselves. At this point, things seem pretty straight forward, so I am going to try to keep the chit chat minimal, and let the charts do the talking. Just The Facts please...

Bitcoin started tacking on 'hundreds' overnight, surpassing the initial target that I had mentioned, and reaching toward the extended targets that I had. I do believe that this is a parabolic move and it will eventually fall just as rapidly. This chart seems to show that we had that type of fall intraday, if it is an accurate chart.

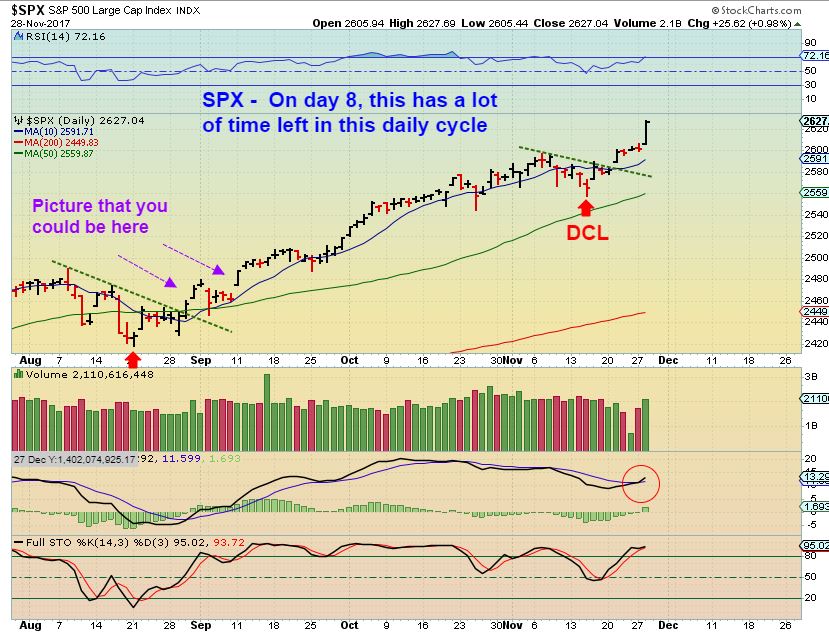

SPX - In the last report I mentioned stay long if you are long, but it may be best to start tightening up trailing stops ( Due to BKX , TRAN, and divergences) and we'd have to see how this plays out. Boom, the long play continues on day 8. Just the facts.

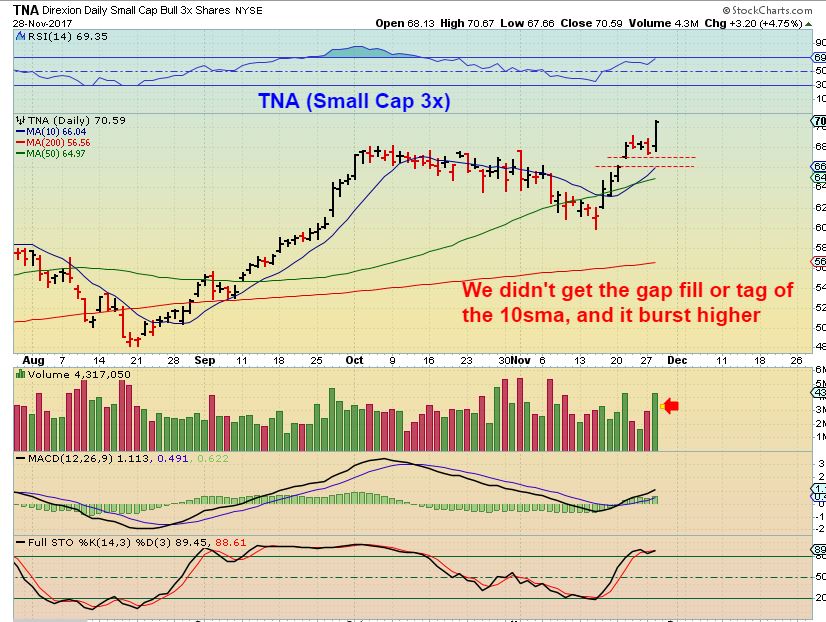

TNA 3X Small Caps - I expected a gap fill and a tag of the 10sma anyway, but it just took off higher. I'd keep a stop under the 50sma & raise it as price rises.

Tuesday November 28

November 28, 2017 /101 Comments/in Premium /by Alex - Chart FreakToday I want to do a quick review of our markets, since not much has changed, and then I will discuss a few more trade ideas. We have been killing it with Bitcoin or blockchain trades, but another sector deserves our attention too. I have mentioned it in the past couple of weeks, and I still believe that it is also ready to go.

5 Charts to discuss the markets

SPX - The DCL is in place, so this is another long position in a bull market for those that trade the SPX, UPRO, etc. Is it blue skies ahead? Maybe not, so for those riding TQQQ, please see the next chart...

Nov 24th – The Blockchain Explosion!

November 27, 2017 in Public /by Alex - Chart FreakNOTE: Please keep in mind that this report was written last week as a premium report, while Bitcoin was between $7000 & $8000. Bitcoin almost hit 10,000 this weekend, and a follow up premium report was posted on Monday. The following report gives you an idea of how we were viewing the blockchain charts. It also briefly discussed OIL, the XLE, Gold & Miners.

.

While waiting patiently for the Gold market to set up properly, we have been trading other areas, and one of those areas recently has been the Blockchain trades. I mentioned that I had been trading these on the side, watching how they play out, seeing if they act as expected, before including them in the reports. Well, they are quite volatile, but I was having success trading them, so I came to the conclusion that they were trade-able and that maybe I should put them in the reports with a small warning about risk last week. So we started trading Blockchain last week.

I'm not sure who decided to take these trades with me, and who watched from the sidelines, but I want to review some of these explosive moves (and gains) and point out a couple more set ups that may be ready to follow the leaders.

RIOT - This chart showed a consolidation that I had been trading with BIG SWINGS. After a series of lower lows, we see a higher low Nov 13 and it looked ready to break out, so I Used this chart as a buy and...

RIOT - This chart to show the bigger picture potential. I named a couple of upside targets that sounded kind of ridiculous, like $14 & $16, even in the $20's.

RIOT - I sold 1/4 of my position at $16 & posted that in the comments section. Then it after hrs, it continued to ramp up and was at $18.35, so I placed a sell for 1/4 at $18.30 & it sold immediately. I mentioned this in the comments too, so that others could follow if they wish.

GLNNF - GLNNF, RIOT, and PRELF were the main ones that I traded as an experiment. GLNNF has been very quick mover too, but they are also getting very exuberant and parabolic when they take off ( Bit coin is breaking new highs too). I sold this one a bit early every time, but with solid double digit gains. I mentioned this one near $1.20 I believe, and I sold it at $1.80 ( Red Arrow = early again) 🙂

So let's take a look at some other trade ideas in this sector...

Monday Morning- Blockchain Part2 And More

November 27, 2017 /183 Comments/in Premium /by Alex - Chart FreakLet's discuss a few of our current trades, and please do not just 'skim the charts', you need to read the cautionary notes in print too.

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine