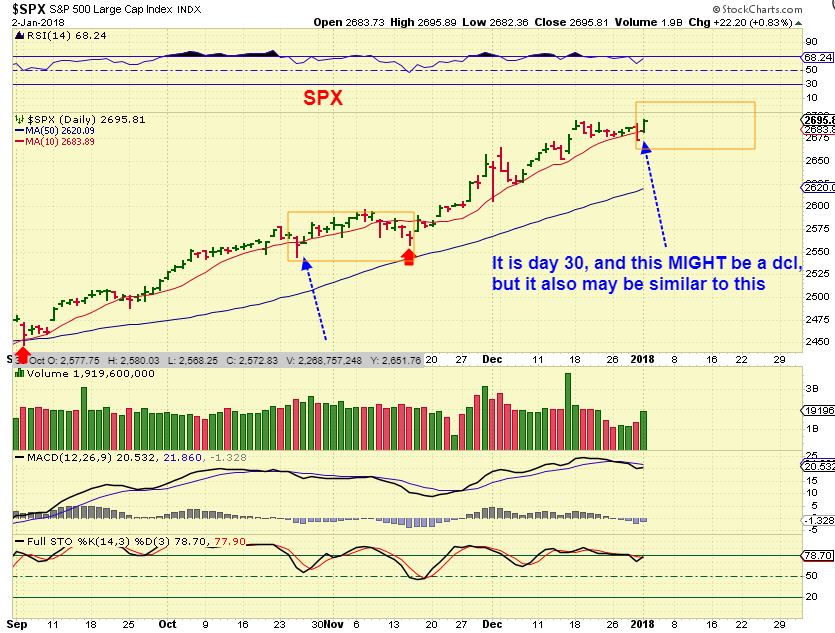

Wednesday Jan 10 – It’s Just A Pullback

We will discuss the Miners and the current pullback after a quick review of various Market Sectors.

.

SPX - This is often a topping candle, a reversal , but lately the SPX just drops down to the 10sma and may fill some gaps if it does.