Archive for year: 2019

Friday Sept 6th

/in Premium /by Alex - Chart FreakToday is Friday and this is the last trading day of the week. I'm going to start the report with 3 charts from yesterdays report, and then we'll see what happened as Thursday played out.

.In yesterdays report I mentioned...

.SPX – The MACD is bullish and we are no longer dropping to the bottom of the trading range, so with mini-higher lows, this could be preparing to break out. As day 21, I’m not sure how high this run would be able to go before a dip into a DCL would come due. ( Fed Mtg?).

.

.

SOX – With the volume increasing on the upside push, the SOX ( SOXL used for volume) may be leading the way, after dropping to a gap fill Tuesday and breaking above that 50sma Wednesday.

.

.

SDS – Also we have the inverse S&P 500 , an it looks like the sideways consolidation here is weakening. This could double bottom and the SPX could double top.

Read More

Read MoreThursday Aug 29th – There Are A Few Choices To Be Made

/in Premium /by Alex - Chart FreakIn this report, I want to review the markets and discuss a few choices that we have at this point...

Wednesday August 28th

/in Premium /by Alex - Chart FreakWe are invested in the Bull Market of the Precious Metals Sector, and even though the weekly charts are looking a bit extended, we keep seeing surprises to the Upside, as upside targets continue to get hit. I did mention in the weekend report that this could be an up week for the Miners, so let's take a look at the Market action ...

I'm not going to spend a lot of time on other sectors, there has been no important change. As a quick review...

.

SPX - No change, and this recent trading range could be a back test, held back by the 50sma.

Tuesday August 27th

/in Premium /by Alex - Chart FreakIf you were watching the 'Futures' on Sunday night, then you know what kind of price action & volatility the markets experienced. If, on the other hand, you simply look at the charts after the close on Monday, you wouldn't really notice anything out of the ordinary. Let's take a look at what is happening with our various Market Sectors...

August 24th Weekend Report

/in Premium /by Alex - Chart FreakAfter a very choppy sideways start to the week, the FOMC Minutes release on Wednesday was a non-event, but when we reached Friday and the Jackson Hole speech was delivered, it looks as though we finally have our 'directional' trades revealing themselves. The China trade wars and the Jackson Hole speech did seem to shake things up a bit. I usually mainly discuss the Big Picture in the weekend report, but this report will contain some short term possibilities with daily charts & The Bigger Picture.

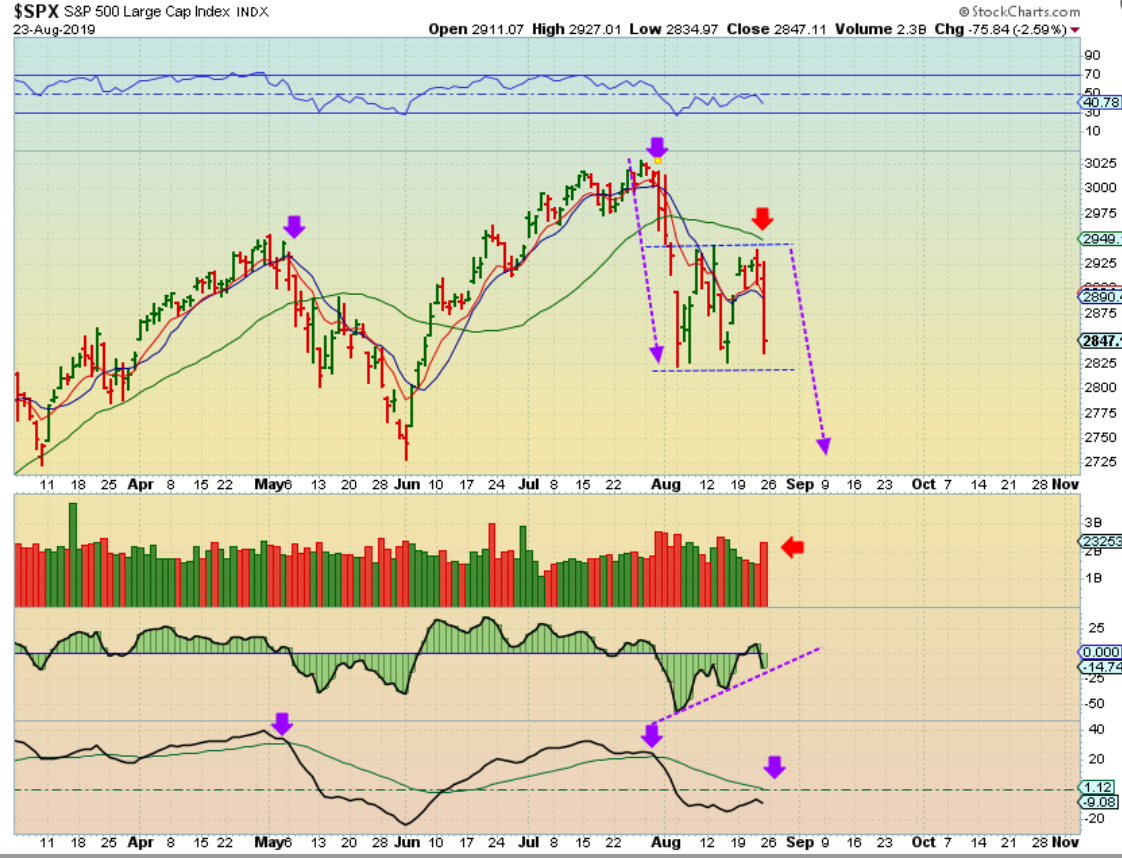

SPX DAILY - That was a big drop with heavy volume Friday and this is only day 14! We have plenty of time for this to really sell off. The General Markets closed below the 10 sma, and this definitely looks like we will revisit the June lows short term, and possibly experience an even deeper drop & break down. The Big Picture shows a possible large drop too...

.

SPX WEEKLY - LAST WEEK I showed you tthis break down and possibly 'just a back test' during this chop, and now it looks to be breaking down further...

.

SPX WEEKLY - In the past, I have also pointed out this possible Bullhorn or magaphone in the Bigger Picture, and the idea is still valid. This has been warning that we could have a deeper sell off at anytime, rather than 'New highs & Blue skies' at the '5' area, as many used to think.

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine