March 7th – After The Storms

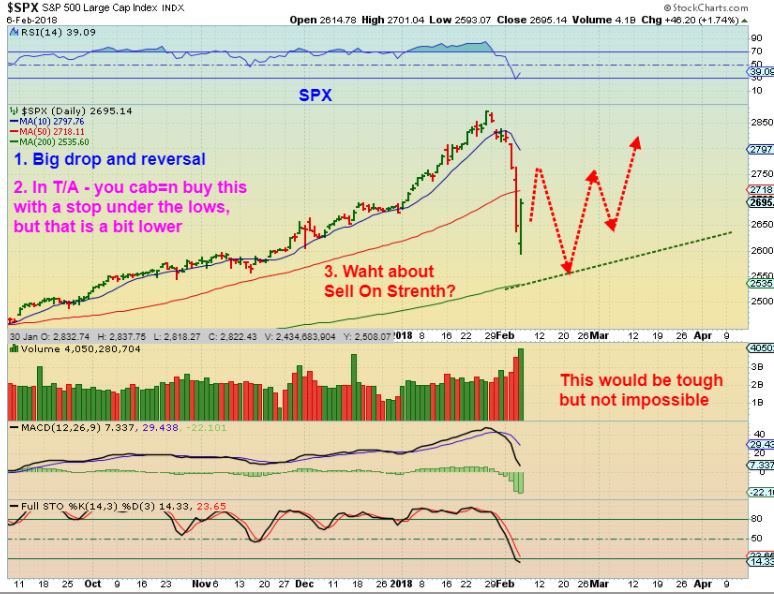

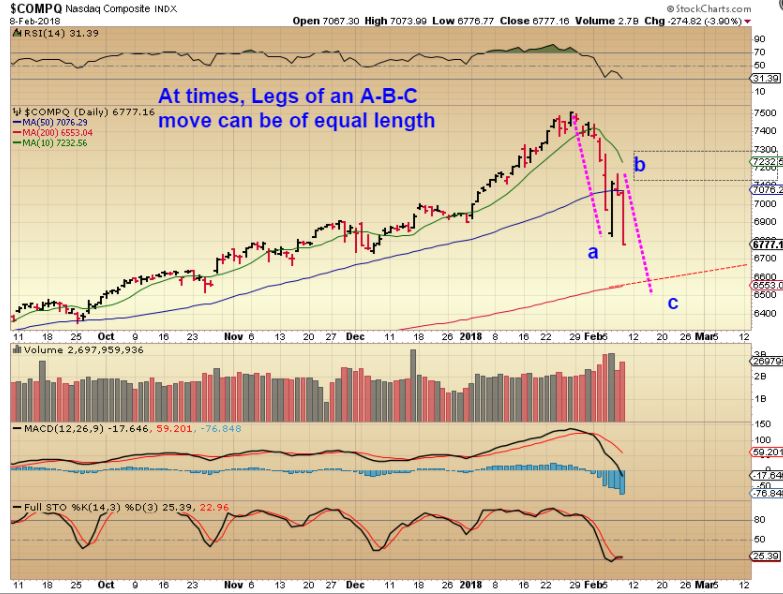

The markets have been choppy lately, and early February was really a bit stormy, but after the market storms clear away, opportunities often present themselves in the manner of trade set ups. We have been taking advantage of many of those lately.

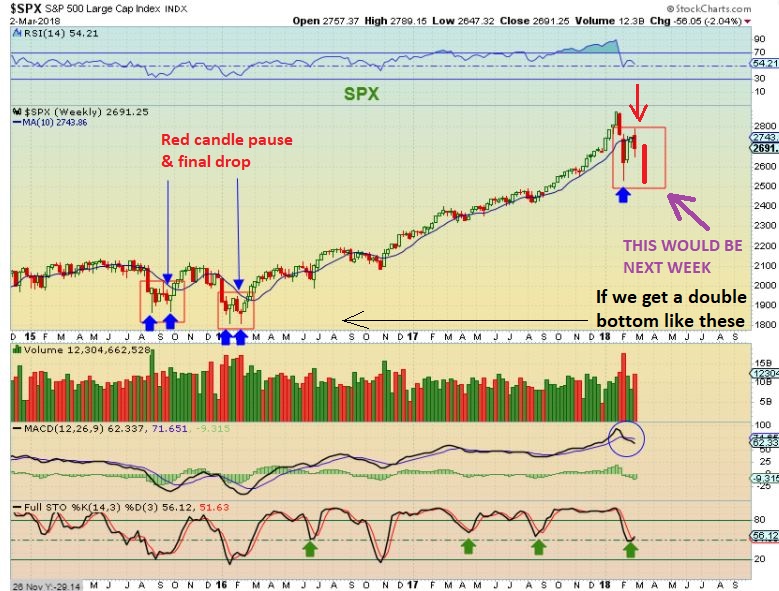

I guess that we can't really call yesterdays Gap down a storm of its own. Yesterday I pointed out that this is where the markets were set to open ( Purple square). Would they continue to sell off, or would they be bought back up?

SPX - You can see that the gap open did not sell off further, but steadily climbed through out the day. Adding in this area with a stop below March lows is reasonable. The SPX looks to be crawling under the 50sma, and this is common, but ...

Read More

Read More