On this holiday week of trading in the U.S., the markets often have a bullish bias, as traders leave early and travel to be with family. At this point, the Markets do seem to just be continuing higher...

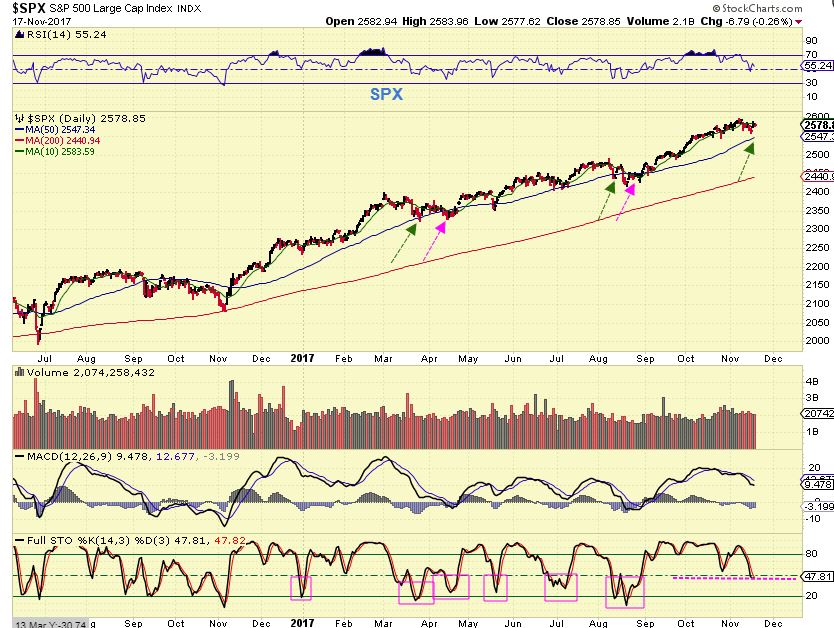

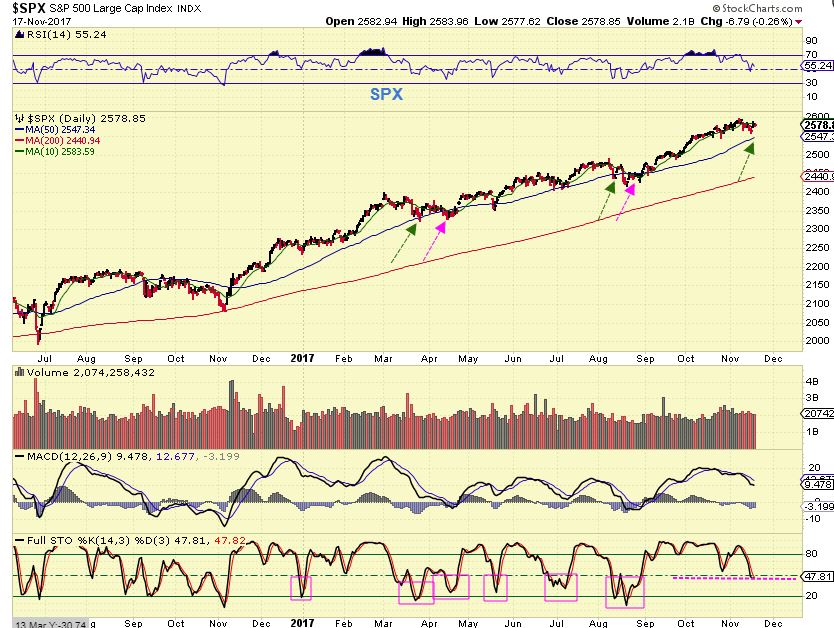

SPX - I would say that this is day 4 of the new daily cycle. Do not stand in the way of this  . Each consolidation leads to another leg higher. It remains a 'buy the dips' market.

. Each consolidation leads to another leg higher. It remains a 'buy the dips' market.

Read More

Read MoreIn the U.S., Thursday is a Holiday and the markets will be closed, followed by a 1/2 day of trading on Friday. Usually many are traveling to be with family on Wednesday afternoon, so the markets volume & trading lightens up on Wednesday. That said, it is a bit hard to know exactly what to expect going forward, especially after Tuesdays trading. For now, lets take a look at Mondays trading, and review a couple of the 'Changes' that we discussed in the weekend report.

Read MoreIt comes as no surprise that markets can evolve and change over time, so when a change appears, it is best to listen. It may or may not amount to anything in the long run, but we take note of any changes anyway. That said, I have seen 'changes' in the markets this week in a couple of areas, so we will listen, discuss, and prepare. As I mentioned, they may not amount to anything permanent, but we still need to listen and prepare, so let's discuss some changes in the weekend report.

SPX - No change here, but I wanted to point out that in the past, the SPX did visit the 50sma a couple of times before moving higher. These were areas of ICLs that did not sell off as deeply as the ones in the past (see JULY & NOV 2016). So, will the markets just continue higher, or are we coming due for one soon?...

Read More

Read MoreToday is Friday and it is the last trading day of the week, so let's take a look at the markets and then discuss a couple more trade set up ideas.

Read More

SPX - The drop continues as the SPX is seeking out the next DCL. The trend line is broken and the 10sma has been lost. I actually thought that the 25th could have been a dcl, with the trend line break and close below the 10sma, so now I am simply watching for a swing low first, and then a close above the 10sma. Either I drew the trend line wrong and the 25th was not a dcl, or this is a very L.T. daily cycle on day 15. The divergence that I was pointing out over a week ago is playing out, so our 'caution' was warranted.

ALSO ...

Read More I would say that we were seeing a normal correction in Oil on Tuesday, and we are heading into the Oil Inventory reports Wednesday, so nothing really changed there. So why did the Theme become "Winds Of Change?" It is because OIL stocks started to pick up in their selling, The Euro situation changed, Biotech broke down further, and a couple of other minor changes also became evident. I wanted to discuss these areas a bit more and the changes that I noticed...

SPX - Each sell off lately is still being scooped back up, but I'm still seeing the divergence that I pointed out a week or so ago as Price went higher. The RSI & MACD are still drifting lower. There is still room to drop on the stochastics, so this time price may want to also drop to the 50sma, or even continue sideways to that 50sma. Why? ...

The TRAN, RUT, BKX, etc., broke below their 50sma. Let's take a look.

Read MoreYeah, that little guy on the left is rather precious to it's dad there, but I'm talking about Precious Metals here. Let's discuss what I mentioned in the weekend report about the coming sell off that I expect in Gold, Silver, and Miners, and discuss what we might see ...

I started with these 2 charts, one of GOLD

And the other of GDX

But I also included this chart and it raised questions in the minds of some of our readers, so let me discuss this a bit further...

Read MoreQUICK REPORT ON THE FAST TRADES FOR OUR TRADERS

.

MYMMF- Bought at 42 cents

MYMMF - Hit $1.26 today.

Do we have another set up similar to this and the other ones? Yes, I believe we do...

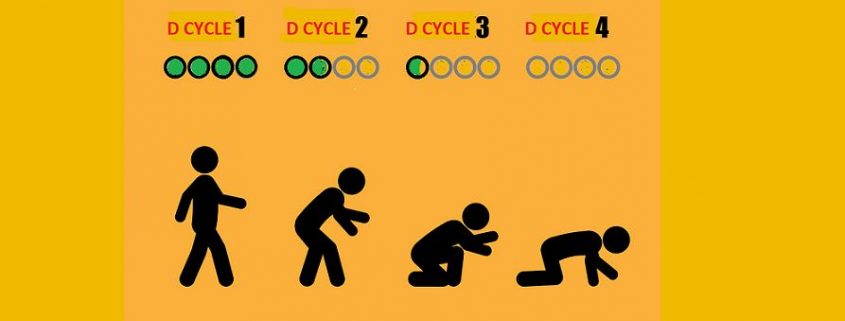

Read MoreThis weekend we'll discuss how the markets behaved last week, and at the end of the report, I want to also touch on daily cycle strength. Visuals may help things to stick in our minds

SPX - When looking at past ICLs ( deeper meaningful lows), we can see that the dips have not been as deep as they used to be. This is showing the markets strength over the past year. I now can draw a middle line as recent support. Please excuse the type on the chart 🙂 We do look due for a dip down sooner than later though, don't we?

Read More

Read MoreSO MUCH TO WRITE ABOUT, SO LITTLE TIME. Today is Friday, the last trading day of the week, so a quick review and a discussion on a few trade ideas...

.

3 SPX CHARTS

.

SPX#1 - Thursday saw the Markets gap down, sell off, and then start to recover, so we get another 'buy the dip' reversal, however ...

Read More

Read More

Scroll to top

. Each consolidation leads to another leg higher. It remains a 'buy the dips' market.

. Each consolidation leads to another leg higher. It remains a 'buy the dips' market. Read More

Read More