https://chartfreak.com/wp-content/uploads/sites/18/2017/05/change.jpg

573

875

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

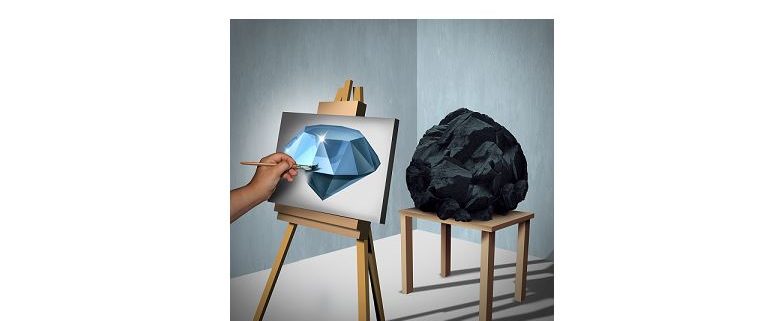

Alex - Chart Freak2017-05-18 11:21:472017-05-18 13:19:15May 18th – ChangeThis mornings futures show the markets down a bit, but they have been holding up well lately, especially the Tech area. Let's do a little pre-market review...

.

SPX chart from Yesterdays report. We are still due for a dcl, but the pullbacks have been shallow.

I like to use the NYA too, and this is a bullish set up / consolidation so far. If it continues to hold the 50sma, it remains bullish looking .

We also have been keeping an eye this...

Read More

SPX - They just dont sell it off for long anymore, do they? New highs.

Read More

Read More That sunset sure is a beauty, and this chart below is also a beauty to many of us that went long...

Read More

NASDAQ - The NASDAQ continues to climb that wall of worry. If you were long, a trailing stop may work out well, this is now another right translated daily cycle in a Bull Market. As shown in recent reports, Some stocks are doing well with earnings, and others are getting crushed. Add NVDA & TSEM to the 'doing well' group. Yelp & SNAP to the getting slapped group.

This is a reminder - This was my My February thought showing a possible parabolic blow off top . The pattern is similar with a sharp sell off and then a ramp higher.

Read More

Read More

Todays report will be short and sweet, there is no need to cover 'everything' after the weekend report, but it does still include over 20 charts to cover a number of ideas, some new and others that we have discussed in prior reports.

Read More Keeping in mind that we have the French Elections on Sunday and the results can cause a short term reaction, let's review the market action from last week and our current expectations.

SPX WEEKLY - The SPX finally broke to new highs last week ( We know that the Nasdaq has been running like a bull).

SPX - The SPX will be due to drop down into its own ICL soon. In the past the 200ma has been rather reliable as a support. Since the 200 is rising, maybe the SPX will see 2300? As you can see from previous drops down into an icl, a drop like that can take a few weeks once it starts to roll over. "Sell in May and go away?"

Read More

Read MoreLets get right to the report...

Read More

Scroll to top