In the last few reports I have been discussing a good number of bullish trade set ups that have been forming after sell offs and consolidation periods. In some areas, the entire sector seems to be reacting. We will continue that discussion today.

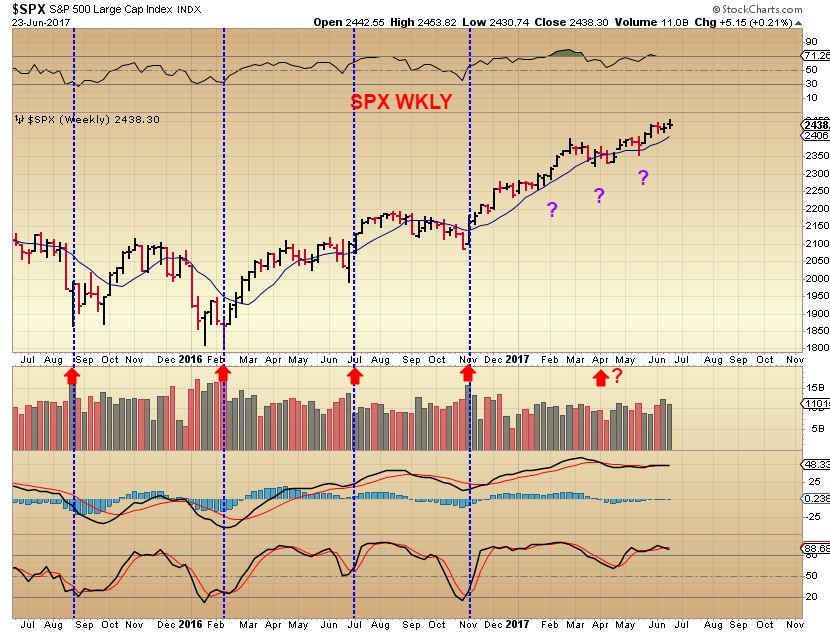

SPX FROM JUNE 23 - The bulls and bears are battling, but this looks like a topping process. We are due for a correction in the general markets.

QQQ - Monday saw a bit of a bearish reversal in the Q's, and that MACD is not showing signs of strength.

I discussed in the weekend report that we are due for a steeper pull back into an ICL, and...

Read More

SPX - We are really well along in the entire intermediate cycle, so I would expect this daily to top and become L.T. and begin to drop. We are overdue for an ICL, but these markets have just been pure bullish.

Read More

Read More

This was my IBB Weekly chart on June 20th. It is breaking out in bullish manner ( It hit 316 yesterday) and has the potential to get to 330 in a few weeks. The daily chart could back test the break out or it may just bull flag and continue higher.

I will discuss this further later in the report.

Read More

So far, The SPX has put in a swing high every 4 days or so, 🙂 and here we see another one. Since we are getting late in the intermediate cycle, and since we are on day 22 of the daily cycle, I am watching each swing high as a possible top. A break of the lower trendline could escalate the selling, so my stop would be below that.

The NASDAQ...

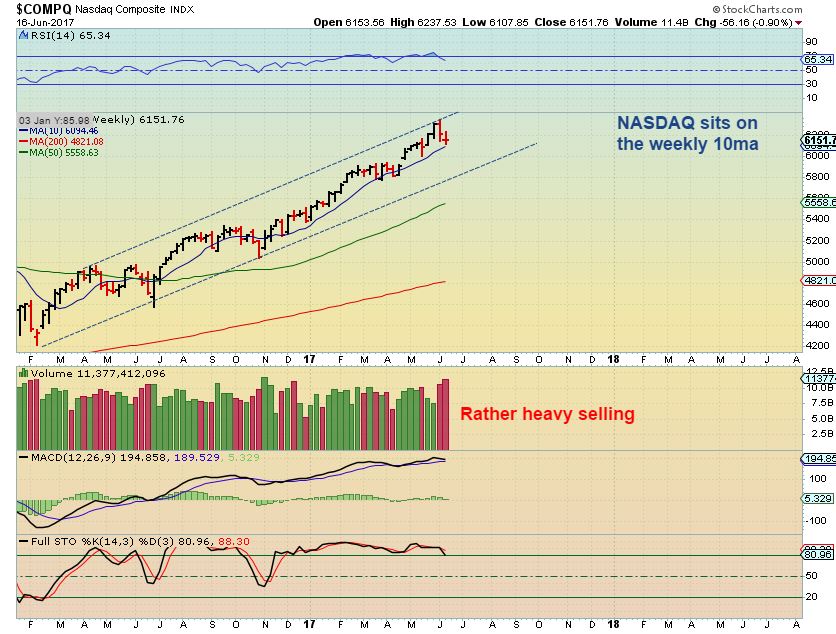

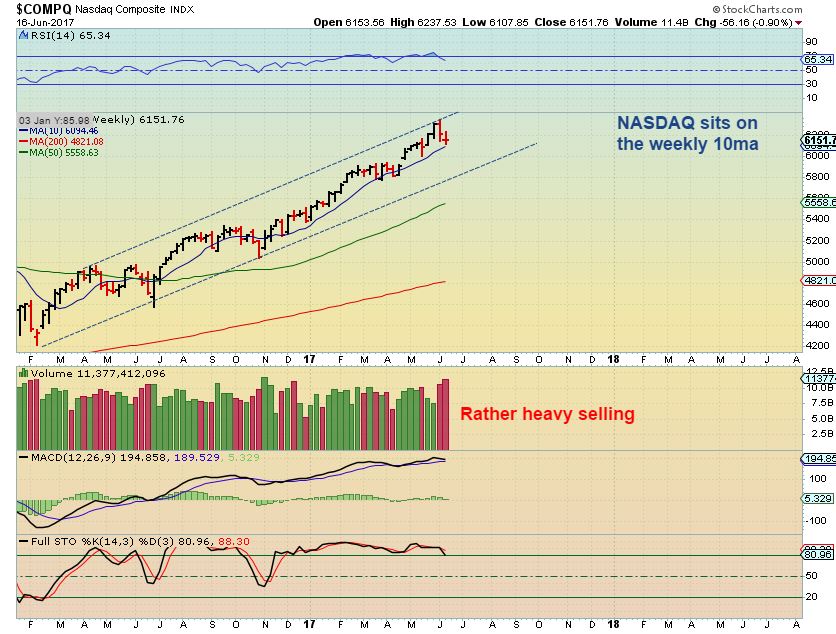

Read More On the weekend, I used this chart to point out that the NASDAQ did find support on the 10 weekly MA. This is often an area that holds as support, so would the markets move higher from here?

The markets did move higher, and I would use recent lows as a stop.

Read More

Read MoreI posted the following 2 charts in the weekend report as a reminder of a few trade ideas that we are currently watching. I have a few more that I wanted to add before the market opens...

NAK - we have been accumulating this on and around the 200sma for months. Friday mornings report showed that NAK was back on the 200sma, and it popped Friday...

We also looked at this chart again...

Read MoreOn Friday we saw some nice follow through on a few of the recent trade set ups, but Let's start by discussing the markets after the Fed decision on Wednesday.

Read MoreJust a quick report this morning, because today is Friday and it is the last trading day of the week.

NASDAQ - Yesterday I was watching this slight push higher after the sell off, just in case it was a bear flag. The 50sma would be watched for support or failure.

QQQ- About an hour before the markets closed, I posted this chart in the comments / Chat section and pointed out that this actually could be finding support with a reversal at that 50sma. A set up like this can be bought with a stop right below support. TQQQ looks just like this too.

Read More

Read MoreThis is yet another very large report, designed to help you to see the many things taking place in various sectors.

Recently using the QQQ I pointed out that prior drop into ICLs did reach the 50sma

NASDAQ - The Nasdaq didn't drop that much after the Fed announcement, but it is possible that it will seek out an ICL now, since we are late in the intermediate cycle length. That would mean that we are currently seeing a Bear Flag.

Read More

Read More

Scroll to top