In some areas of trading, we see stock picks and stock trades stretching out nicely, and in other areas we see 'cycles' also continuing to stretch out, so lets examine both today.

SPX - I do not think that day 19 was the peak and the daily cycle low of the daily cycle, so that would mean that we are on Day 26. This could pop and run a bit higher, but it is probably going to drop to the 50sma area for the next dcl.

NASDAQ - The NASDAQ got above the 10sma, and that it bullish, however I would imagine that it is only good for a short term trade.

And this is the reason why...

Read MoreIn part 2 of our weekend report , I wanted to provide a few trade ideas for our traders. I am still seeing some very favorable looking set ups, with low risk entries forming. The big warning that goes with these is that we are in earnings season and we are seeing surprises both to the upside and down. Some of these companies have their earnings behind them already, but please be aware of when the others are to be released.

Read MoreLet's review the market action from last week, and see where that puts us.

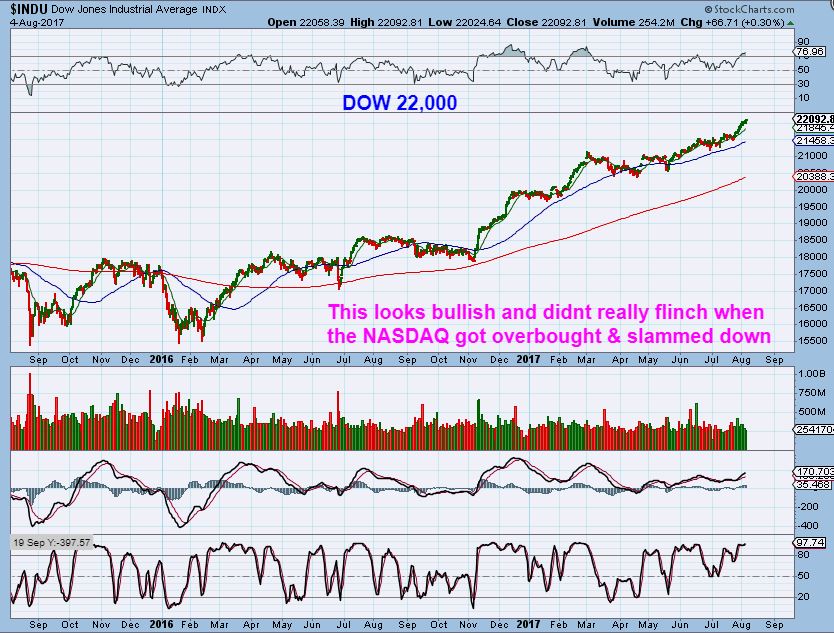

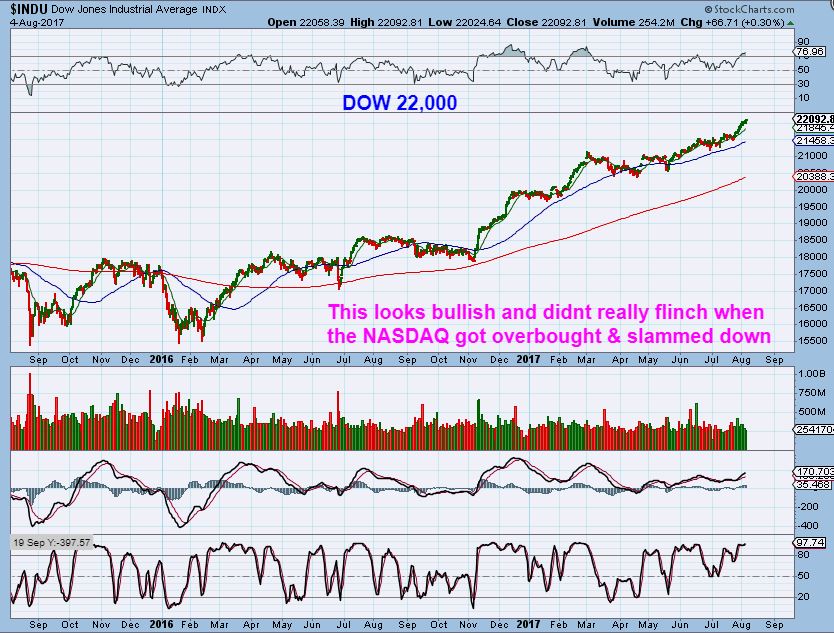

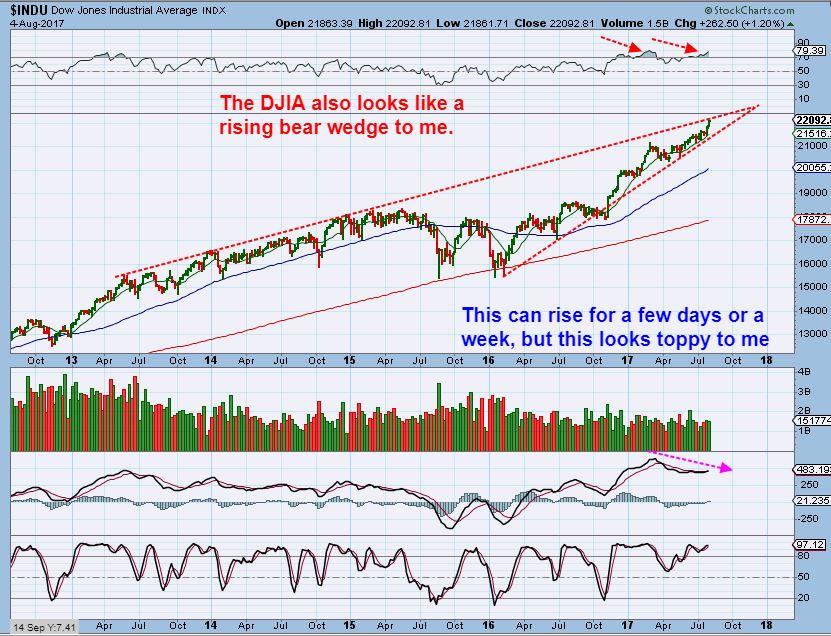

DOW 22,000 was the big deal. The NASDAQ had its day in the light, and now it has been consolidating as the DOW & SPX have been moving higher.

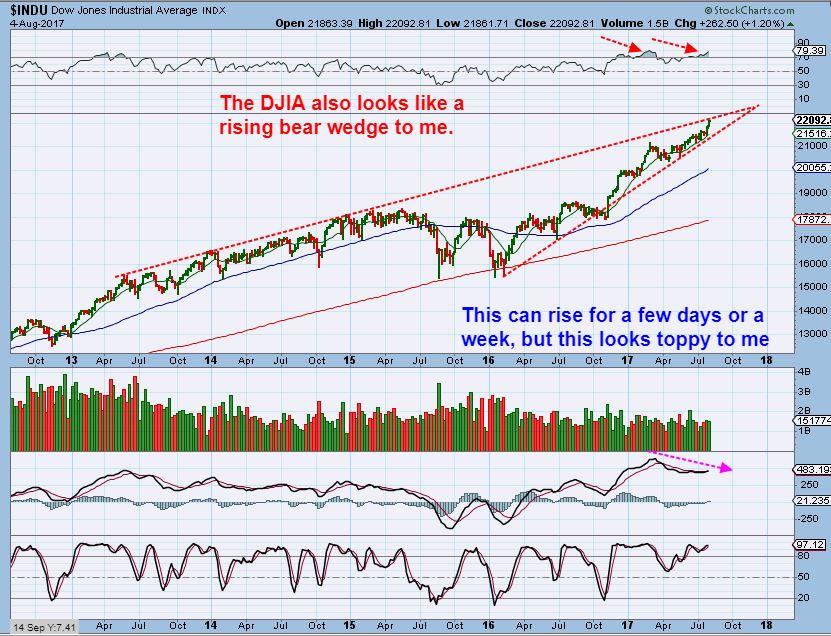

DOW WEEKLY - However , is the DOW getting a little ahead of itself too?

Let's have a look at and discuss the SPX & NASDAQ too

Read More If you were recently stopped out of TQQQ or UPRO, would you really want to start a new 'long' or 'short' position on a Friday going into the weekend, with the NASDAQ on day 25 of its daily cycle?" Probably not, today is the last trading day of the week. Let's take a look at the QQQ, for those already positioned however.

QQQ - Again the Q's closed under the 10 sma and as it gets later in the daily cycle, the more it may not have enough buyers to push it to new highs. Even if it did, it might be a short lived push higher.

Earlier in the week I pictured the QQQs just dropping and tagging the 50sma, and I wasn't encouraging jumping back in, for fear of getting stopped out again.

So far this is playing out, but I wanted to mention something else...

Read More

SPX - We see tails on the bottom of the last few day, so the selling is being met with buying. I would have expected more selling, maybe down to the 50sma, but this might have been a 1/2 cycle low.

NASDAQ - The NASDAQ is still under the 10sma, and is showing 'tails' over the last few days too. In June the NASDAQ only showed a small 4 days pop and then continued lower into a dcl.

Read More

Read More There is an old saying that says, "Never short a dull market." Why? Professional traders know that under the right conditions, a quiet or dull markets can suddenly break out into a strong move higher. I am going to discuss this a little later in the report, but right now, let's visit a couple of sectors that have been a bit more active.

The DJIA is at new all time highs. The SPX is still near the recent highs, but let's look at the Nasdaq & Transports...

QQQ- So this could be a bear flag, and we see that the NASDAQ cannot rise & close above the 10sma yet, even though the DOW is at all time highs. I would remain 'cautious' or alert until it does. This looks like it may want to drop down to the 50sma. Would this dip just be a 1/2 cycle low? Possibly, but it will need monitoring if it does drop further. APPL Earnings were bullish and AAPL is set to open at new all time highs, and this may help the NASDAQ.

TRANSPORTS - I pointed out that we didn't really even get a bounce in the transports, so I wondered if this was a warning sign. We got a drop, multi day pause, drop, multi day pause so far. Looking at the IYT now, I see a possible 5 wave move to the 200sma, and it is approaching oversold.

The Transports obviously broke down here, but at least a bounce to back test that 50sma is likely.

Read MoreWith all of the detailed daily reports pointing out just about everything there is to look for, I like the weekend report to usually just be more of a big picture look at what happened over the past week and what we can expect going forward. Well, there is just too much that stands out to me at this time, so I will cover the bigger picture and some of the smaller details too.

SPX - I understand the "buy the dips' Theme in a bull market, but is every dip being bought profitable or easy to buy & hold? This week we saw a market slam down on Thursday, and Friday had a small reversal. Was that 'Buy the dip" on Friday? Notice June 12th.

The timing on June 12th for that slam was also similar to this past weeks slam, and price went sideways to lower for 4 weeks into a dcl. ( Each 5 candles is a week of trading). Buying that dip made no money for weeks actually.

SO NOW LET'S CHECK OUT THE NASDAQ ...

Read MoreWe all watched the markets slam down quickly mid day on Thursday, and then they rebounded back a bit as the day went on. Bungee Markets are not all that fun to ride, so let's take a look at our Thursday trading...

Read MoreWe did see a Bullish reaction in Gold immediately following the Fed decision, so let's take a look at a few charts...

Read More

Scroll to top