You are here: Home1 / Exclusive Strategies

https://chartfreak.com/wp-content/uploads/sites/18/2016/06/T-D.jpg

580

913

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

Alex - Chart Freak2016-06-01 04:15:252016-06-01 04:15:25Technical Difficulties

https://chartfreak.com/wp-content/uploads/sites/18/2016/05/TRUST.jpg

518

898

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

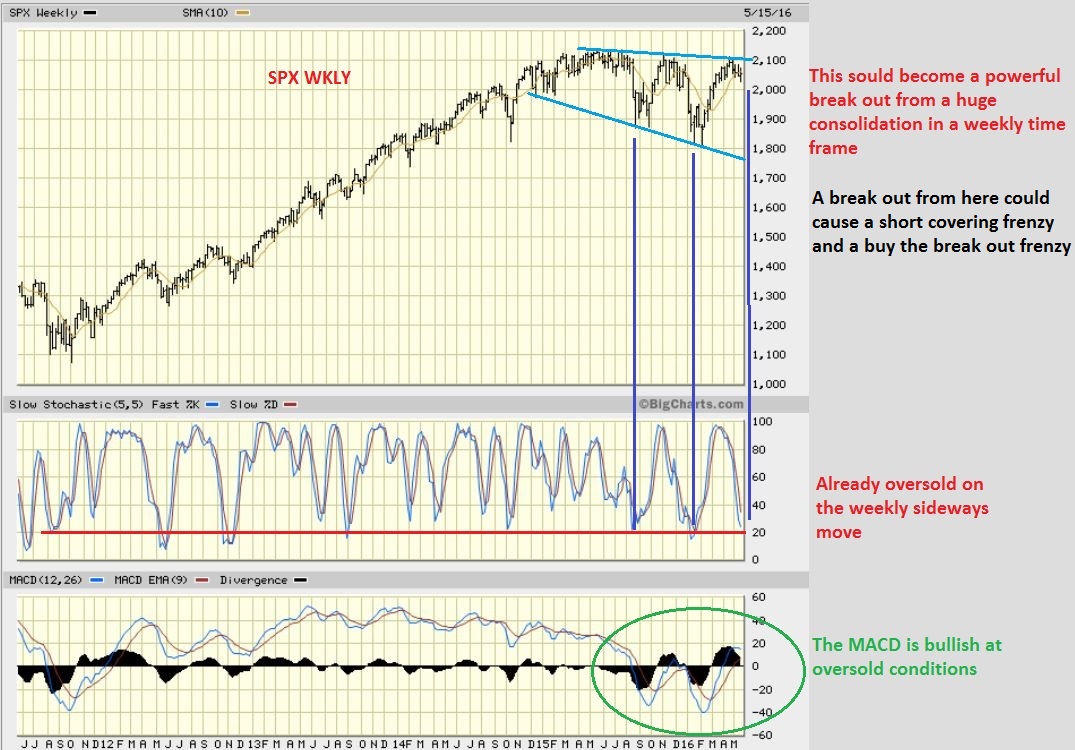

Alex - Chart Freak2016-05-28 15:51:132016-05-28 16:18:06Trust IssuesNot much has changed from Thursdays report. Janet Yellen speaks today and she possibly could shake things up with some dovish or hawkish talk, so we'll see how that goes. And then all then traders in the U.S. will have a 3 day weekend to think about it.

.

If you are heavily invested and you'd rather not think about it on your weekend off, you may want to lighten up.

Read More

Scroll to top

Read More

Read More

Read More

Read More