You are here: Home1 / Exclusive Strategies

Something interesting taking place in the General Markets

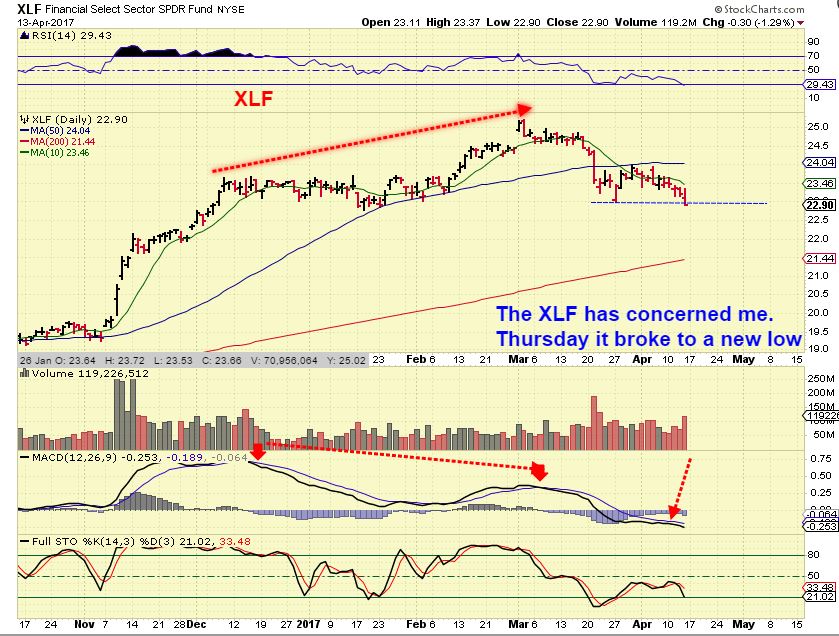

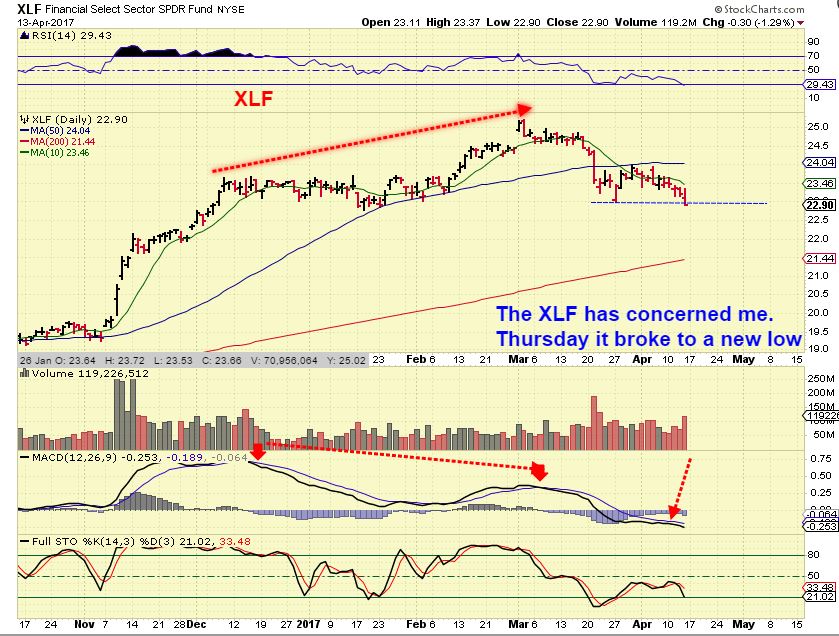

SPX - Here we see the ICL in November and 2 dcls that followed. Obviously the markets have been relatively strong, because those dips down into their dcls have been shallow. Over the last 2 weeks I mentioned concerns about the XLF and then the SPX broke below the 50sma last week. The 'timing' dictates that an ICL is coming due and since the XLF has been weak, so I would expect more of a dip now or soon. At this point, I'm actually noticing some interesting developments taking place here too, so let's discuss that. Notice how the recent consolidation does look similar to the last one at the dcl...

Note: That last dcl has not been broken and a break out here is not out of the question, and here is why.

Read MoreLet's review what the markets have been doing and what that can mean for this weeks trading.

I have repeatedly said that the condition of the financials has concerned me when viewing the markets. Weakness there could bleed over into the general market.

XLF - Friday the XLF broke to a new low, taking out the last DCL. I now expect the financials to sell off over time.

XLF WEEKLY - The weekly chart shows the weakness too.

Read More

Read MoreAs stated before here, there are clearly times to trade and then there are times to just be patient. The best times to trade are after consolidations or bases finish forming , and then the trending moves out of those time periods can continue to carry positions higher. Until that time, trading inside of consolidation periods can be frustrating.

Read More

Scroll to top

Read More

Read More