You are here: Home1 / Public

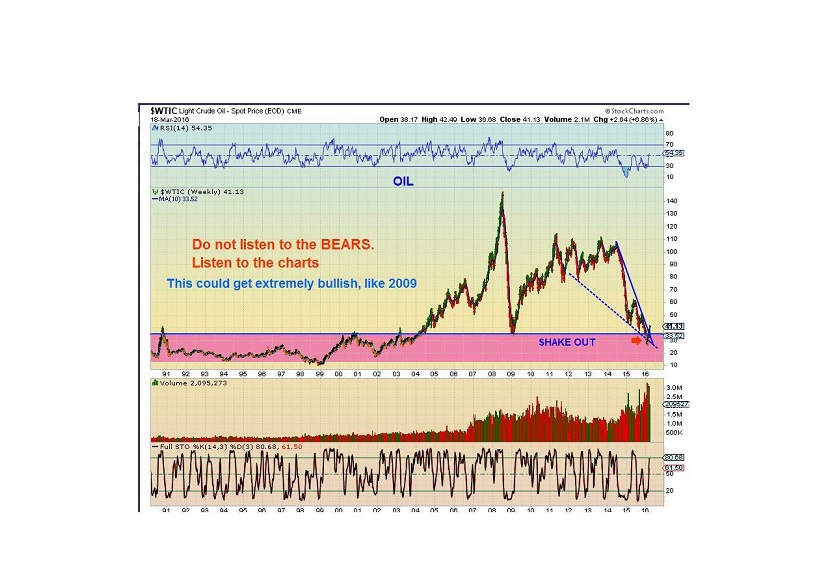

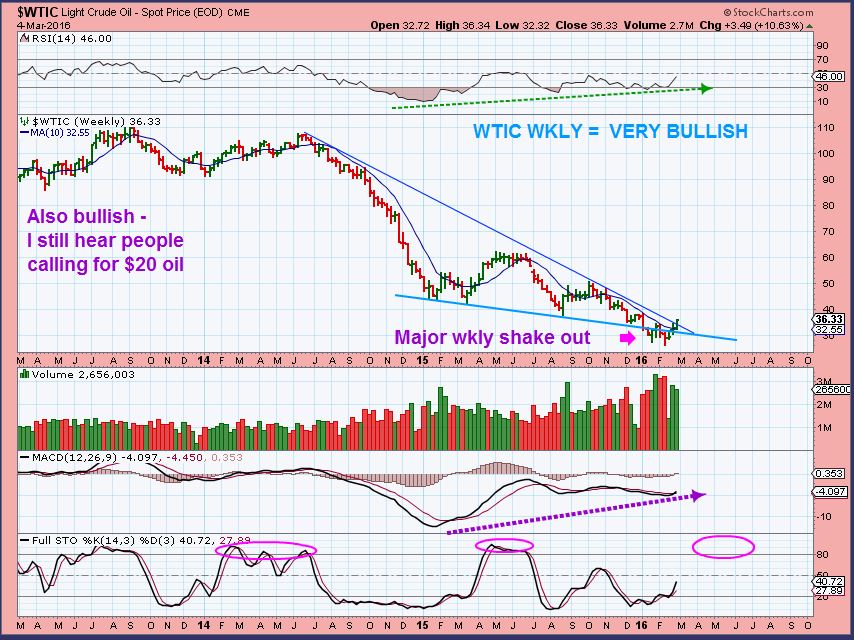

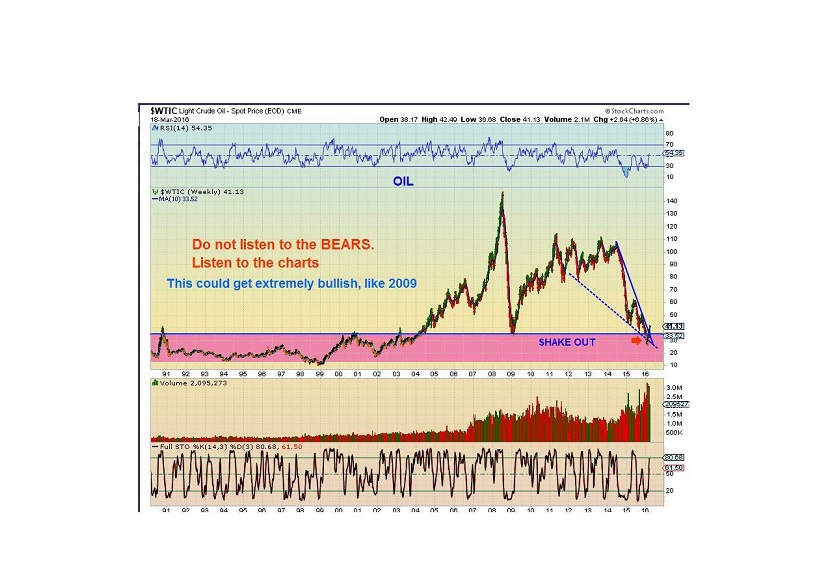

Using charts like the one below, you may recall that I had been call for a low in Oil in early 2016 and snap back rally in Oil and Energy stocks. Since that time, many analysts still called for another price crash, and that includes Goldman Sachs . Is this important? It is if you missed some of the 100%, 200% 300% gains in some of the energy stocks.

Did you see the news today about Oil by Goldman today? This was the headline.

Read MoreWe are at another Fed FOMC Wednesday. The latest Fed Decision on interest rates will be released today, and usually that means we have to get ready for likely volatility. Today I prepared my premium readers to get ready for the trades that the charts are setting up for. Lets review some of what they saw...

.

Last Thursday I showed how Oil would have to work its way through resistance, but was still going higher.

Read More

Read More

Energy Sector Review – It’s all a matter of perspective. If you fell asleep Sunday night and didn’t wake up until after the market closed on Monday, you may have thought that not a lot had happened. If, however, you read my report Monday morning , you saw that Oil had dropped 4% overnight. CNBC and many other sources of information where lit up. Was ‘Oil dropping to the 20’s again’? Was it ‘a great time to go short’? No, Cycle timing and the charts were pointing to possibly just a small pull back. We are invested in Oil & Energy, so this was important. This was our Oil chart in the report.

.

WTIC – Oil was early in the 2nd daily cycle, and the first one was Right Translated. So I expected more than just a day 6th high in this run.

WTIC MONDAY – Many ( Not here at Chartfreak) likely jumped in on the short side pre-market, but the shorts got overwhelmed. This reversal did fill the gap and it did something else too…

Notice this important observation

WTIC – Oil had recaptured the 200sma for the first time in over a year after repeatedly being rejected. It also CLOSED over the 200sma for 5 straight days!

Today when Oil dropped and filled that gap, it actually also got back over the 200sma by the close. I felt that Oil ‘Could’ drop to the 50sma and still be fine, but holding that 200sma for 6 straight closes is impressive in my opinion. Oil remains bullish.

.

Oil reversed , but it still closed slightly down.

The XLE dropped right to the 20sma and reversed higher to close green. This also ‘could’ have dropped to the 50sma and lower channel, but it remained strong.

SO this was actually a bullish show of strength for Oil & Energy, I will discuss Energy a bit more at the end of the report. Lets review the markets.

ENERGY STOCKS

So the ENERGY STOCKS mentioned in last Fridays report ( And the Friday before) Still remain valid. They went on sale today, but most recovered. I did get some feedback that some readers here were buying. I also got feedback that after reading scary things in other trading forums Monday morning, a few sold at the open, basically at the lows of the day. Not knowing whether to buy the recovery as the day went on, I’m asked are they still bullish set ups or did the drop ruin things? Lets look at a few and see why they look and remain bullish to me. In some I’m going to go over the whole big picture for them – it may help.

.

CPG – Breaking out from a long term trend line. It ran $7.50- $11.86 . I show this to show the progress that they are making since being mentioned in the report. This was at the end of Feb.

CPG WKLY – Now $15– It gapped down Monday morning to support, recovered and looks ready to run from an inverse H&S base. This also did not sell off when OIL sold off for 9 straight days.

CNX- Breaking out from $4.53 to $8

CNX WKLY NOW – When you look at a chart like this (weekly) it looks like we would say, ” I could have easily just Bought and hold that from $4.53 and tripled my money soon.” So I wanted to show you something very familiar to us now.

CNX DAILY – This was not just an easy ride. Patience in the consolidation phases was needed, sound familiar? I am showing you this to give you the visual of the day to day volatility in those consolidations. We rode consolidations in CLF, VALE, AKS, SID, and now AA. Also some energy stocks are jumping around and bucking us up & down, but longer term the recovery can be quite rewarding. Just use stops and remain alert. Look at the weekly chart above again 🙂

CLF – Do you recall this chart 1 month ago at $2.60? We probably all wish we could just go back, load up heavy, and ride out that consolidation phase knowing what we know now about CLF. It wouldn’t matter if it dropped 35 cents and then recovered, knowing what was ahead when it recovered.

.

SO again, ENERGY . Many stocks are recovering and OIL is early in the daily count for the 2nd daily cycle. Sometimes it takes a little sideways consolidation before the brek higher comes along.

.

OAS – Roughly $4.20 to $9 since recommended. This chart was from the weekend report. Did it get crushed when OIL dropped 4% today?

OAS – It did drop quite a bit, but it’s still a good looking set up. It went on sale today, but it would have been a scary buy until it moved a bit higher as the day went on. Even if someone didn’t buy it yet, it can still be bought here. Reminder: IT MIGHT continue to consolidate.

.

MRO– When first mentioned $14 was a resistance zone ( Keep that in mind).

This was in last Fridays report, has anything changed?

MRO Monday – Went on sale and recovered quickly. Volume was rather light, but that also means that it sold off on light volume when Oil was down 4%. Since resistance was at $14, it may be building energy to break higher.

.

ERF March 1st- Notice the measured move to $4.

ERF – It ran to $4 and consolidated into a Bullish pattern. I recommended buying this consolidation, because OIL sold off for 9 straight days and this did not.

ERF Monday – After completing another measured move, it dropped today with Oil and reversed higher, actually closing up 6.5%. This has now moved from $1.84 to $5. Great gains.

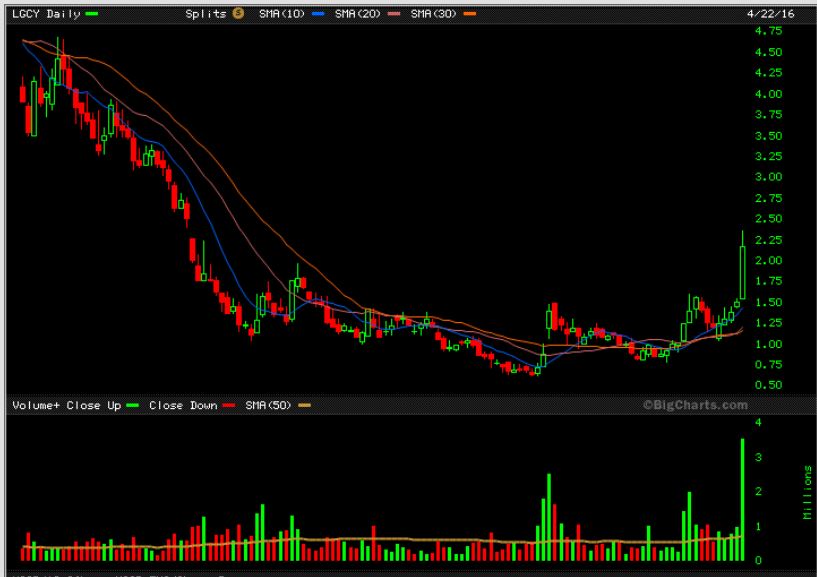

Finally LGCY– This energy stock moves in huge swings. It is scary at times, but this big picture is helpful if this is going to recover too. It was actually over $30 in 2014.

LGCY dropped to the 50sma and started moving higher Monday morning. It also ended up green for the day. Still a bullish looking base.

So please note that in every chart of a stock that recovered, it was NOT straight up. There were many boring consolidations. Mondays drop could be considered part of that process.

.

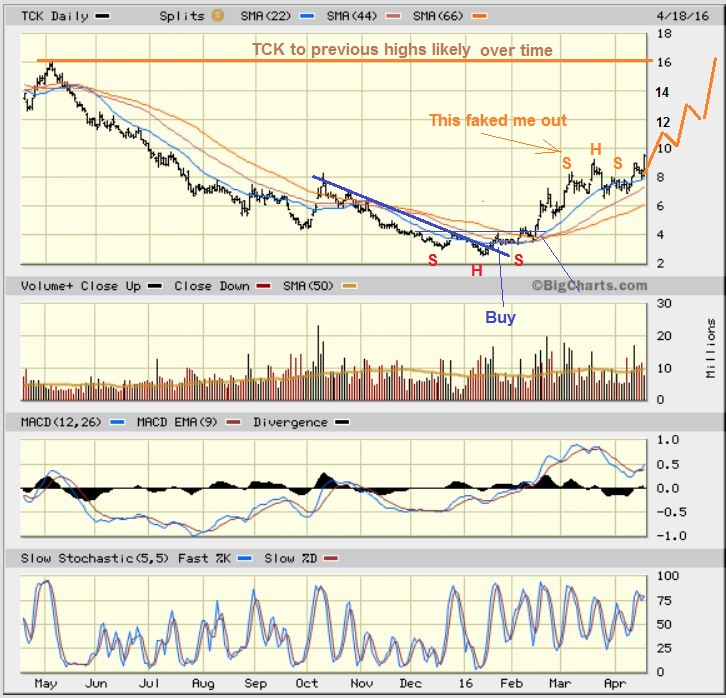

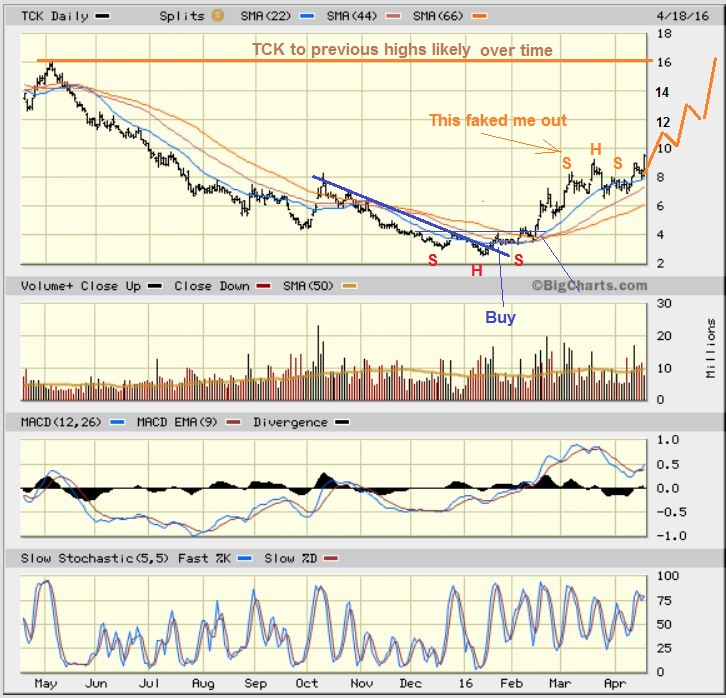

As a part of this lesson, I also wanted to show TCK. What a great looking run, but it too got a bit scary at one point in the consolidation.

Jan to Feb – $2.56 to $7.25 – NOT straight up. Notice the sideways boring moves and volatility.

Then it got stuck under resistance and went sideways from $6-$7. That’s about 10 days or 2 weeks of trading.

TCK Monday – Sideways for over a month now and I even warned about a possible H&S , but it never played out. TCK is now breaking out, possibly for a strong run out of this consolidation.

.

Finally – I found a new stock ( New to me, I have never heard of this company). Hudbay Minerals. They released earnings on Feb 24th , and the stock went higher. Their next earnings release is April 29th. They are mainly Copper Mining. Gold & silver also.

.

HBM – ( HUDBAY MINERALS) – I bought it as a trade since it bounced off of its 50sma and it just kept climbing. It has a long consolidation and a possible inverse H&S , so I will hold on to it until it tells me to let go. I see TGD, VGZ, AUMN, GSS, etc still running strong, so I will try this one until it lets me know that it doesn’t want to run.

HBM close up– I think it may be ready to break out, so someone here also may want to trade it also? Just remember that it is a Copper / Gold Miner and could get caught in a pullback if Gold drops. You could use a stop under the 50sma, or just sell a quick POP if we get one. So far, trading in certain Miners has worked out well.

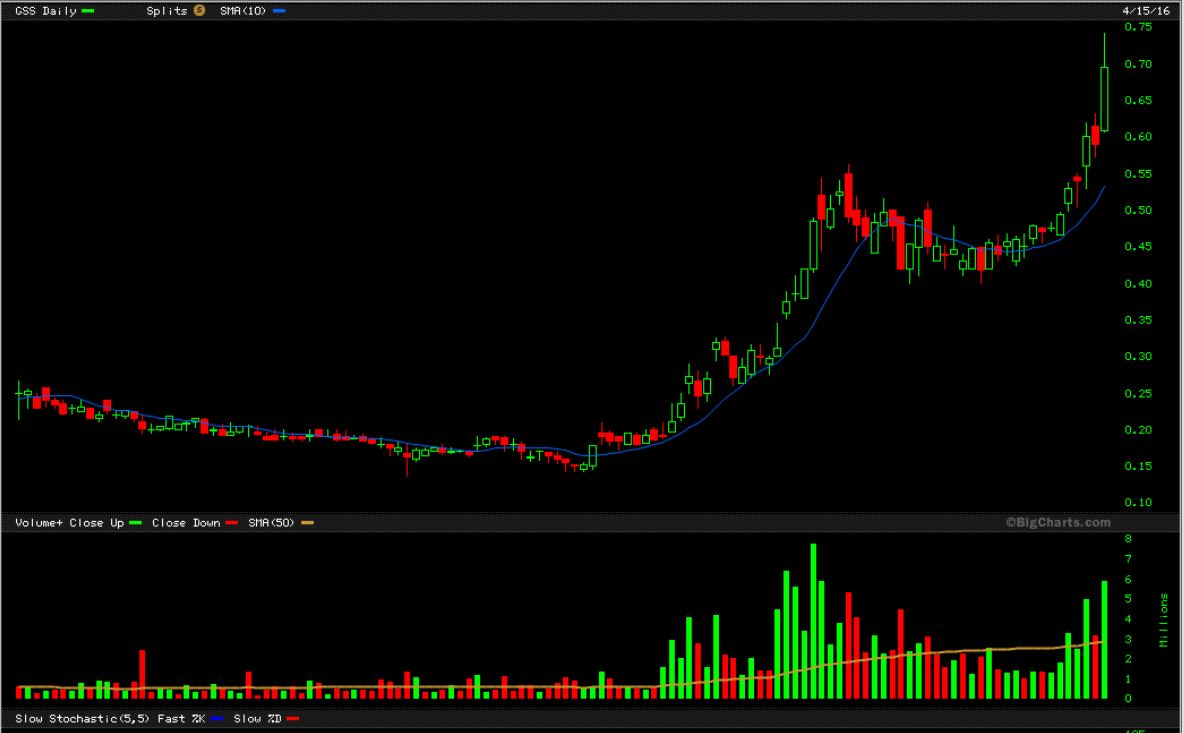

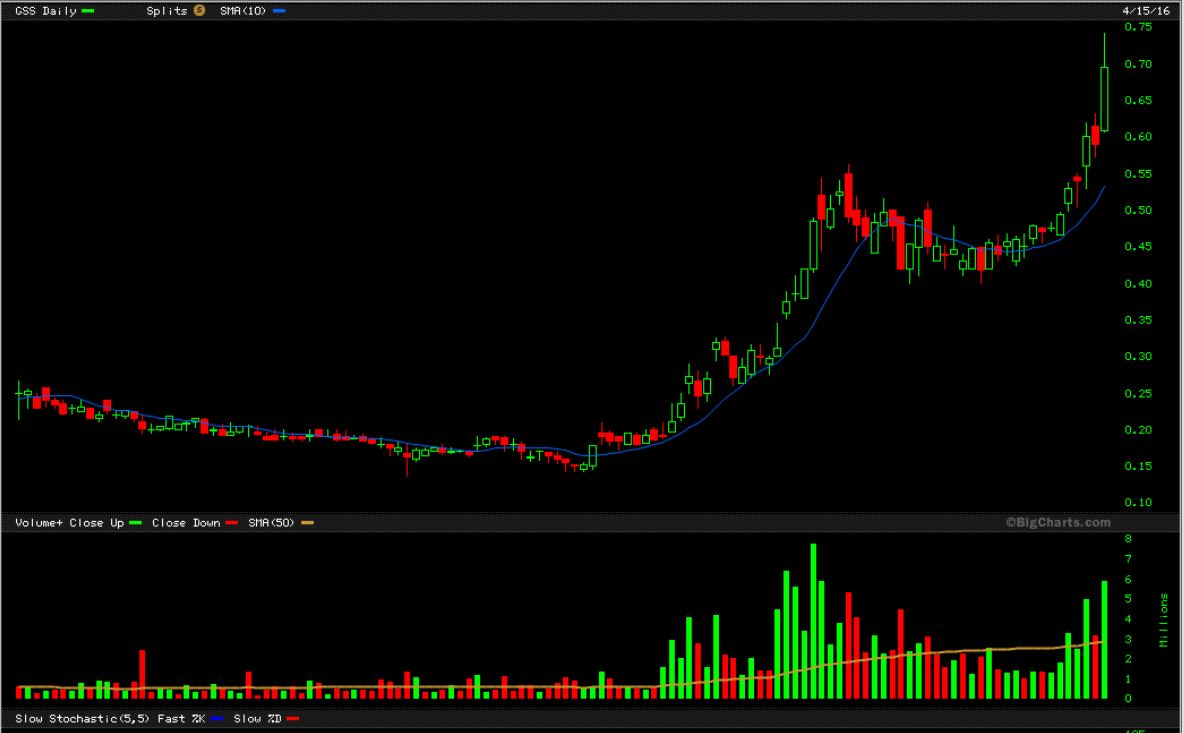

Like GSS in this chart from the weekend report. It continued higher Monday too.

.

I hope you enjoyed this Energy Sector Review. Best wishes and thanks for being here!

NOTE: It’s just $95 for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining ChartFreak and receive hundreds of chart setups and ideas. See >> CHART FREAK – QUARTERLY

~ALEX

I recently wrote up a public post showing what we have been invested in as far as Gold, Miners, Energy, and Commodity Stocks. With careful analysis, we have been able to catch blast off after blast off in a variety of sectors. These runs do not last forever. They run up, then consolidate those gains, and if conditions remain bullish, they can enjoy another run higher. Lets review how we've been doing that.

.

I did call these lows in the General market notice that we did get the expected run higher. I then pointed out in MARCH a bearish rising wedge, so caution was warranted. A drop was expected.

In todays premium report I showed that Yesterday we saw a reversal and the sideways action has 'repaired' that Bear Wedge. It now could be a channel, and the markets can resume their up-leg.

Read More

Read MoreMy weekend report had over40 charts, some for educational purposes and others to point out a few trade set ups. We have been focused on specific sectors and I wanted to focus on what I think could be important at this moment. I'd like to share a small portion of that with you here.

IBB - One area that I've been stalking lately is the the Biotech sector. It has been bottoming for over a month and broke out recently. Lets review what we've been watching.

IBB March 21= double bottom base

Nice break out (But notice the resistance on the left. Were there buyers there hoping to sell at break even?).

IBB WKLY - Apparently so, sellers may be present, but I expect this to go higher when they are out of the way. Thats a nice base. Support is now near $270-$275, The saying is "Buy the dips , sell the rips".

.

SO I HAVE BEEN DISCUSSING BIOTECH IN MY REPORTS

.

Read MoreHere at Chartfreak, we discuss the day to day market movements and trade set ups, but we also review the bigger picture at times too. So in this weekends premium report, that's what we did. I'm going to release about 75% of my weekend report here, to give you some of my bigger picture views. Please remember that since this was the weekend report, many of these charts are from last Friday. Enjoy.

.

SPX QUARTERLY - In 2015, I pointed out bearish signs that I was seeing in the markets and expected a drop. Then I showed subscribers this chart back in January. I was pointing out the break below certain critical areas where bear markets began at prior tops. I said we would watch these on a Quarterly, Monthly and Weekly basis, to see if we have put in another top.

Read More

Read More

This rally has played out pretty much as expected, but I want to point out some interesting changes in character that could affect future trades / trading.

Read More In the premium section of chartfreak, we’ve discussed using Low risk entries to take a position in a stock, but what makes them low risk? Lets take a look at a couple of examples.

.

First, we have been trading sectors that looked to have bottomed recently after seriously selling off . They give evidence of little downside and greater upside. As pointed out here in recent weeks, we’ve traded Miners since January, and Commodities and Oil since February. Lets look at commodities for example.

.

CRB – We caught commodities after the second bottom formed with divergence. The commodities chart still looks bullish after consolidating for a week heading into the Fed Meeting. I believe that this can run higher now.

.

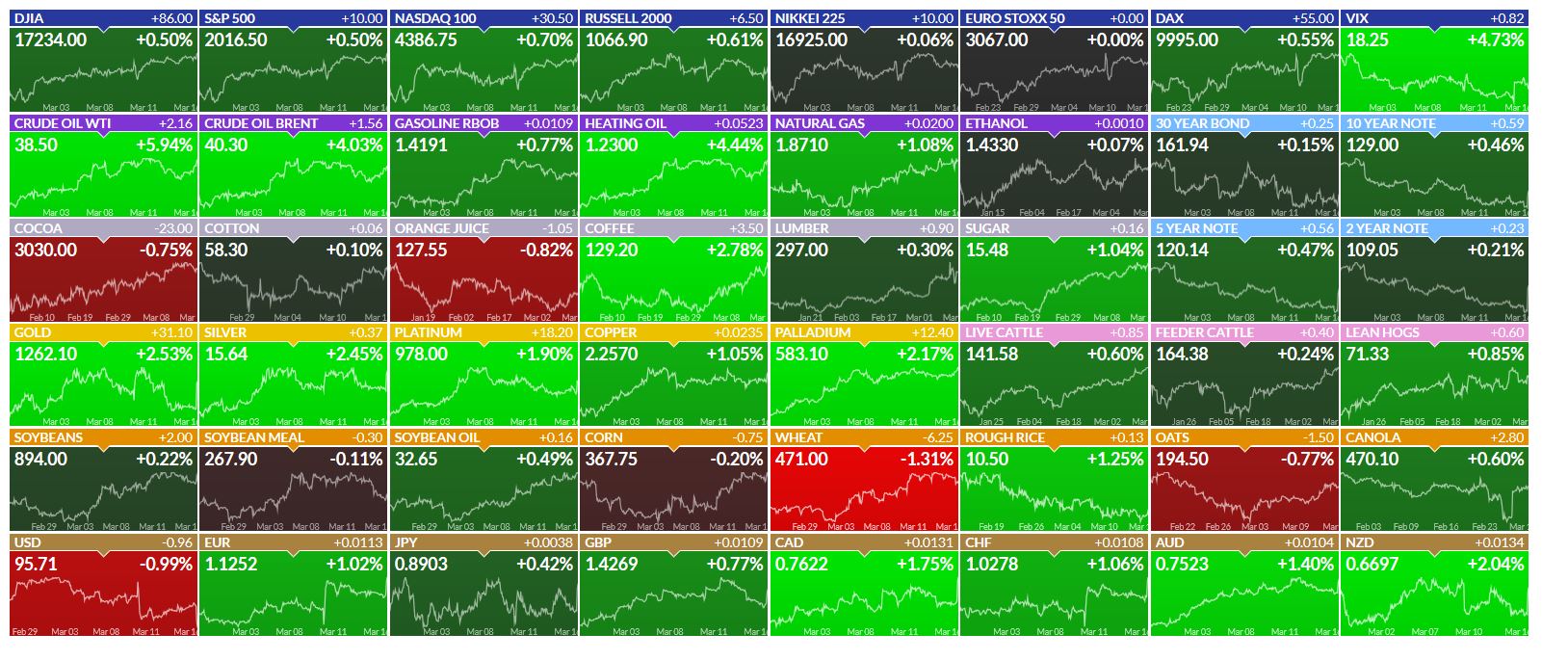

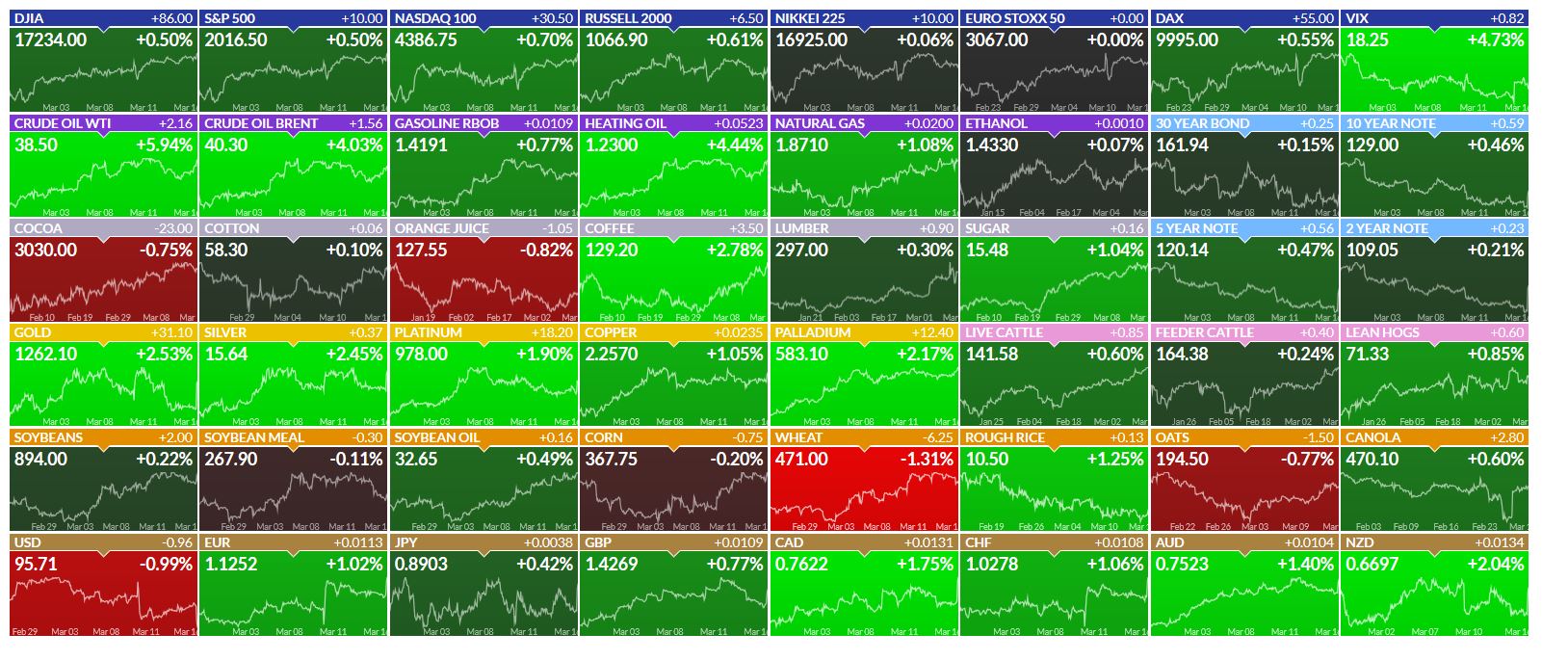

We’ve been watching various Metals stocks pulling back or consolidating after running higher recently. See stocks like X, CENX, AA, FCX, VALE, CLF, STLD, Etc .  Look at The sea of Green in various Commodities after the Fed Decision was released.

Look at The sea of Green in various Commodities after the Fed Decision was released.

.

Sidenote: While I believe that individual MINERS may have a little upside left, Cycle timing says that they should actually be maxing out soon. We will be prepared to buy the pullback at a low risk point. Short term traders have been given charts and instructions to trade individual Miners if they want.

So lets look at my recent lessons on trading and then watching a stock like VALE pull back after a nice run higher.

.

VALE – I bought Vale near the gap fill in the $2.50 area, after watching commodities bottom. On March 1st, a second lower risk entry point would be the break above the 50sma and trend line back test too. Why low risk? Because you could place a stop a little below those moving averages to limit risk if the trade goes against you.

I called for a run to the $4.80 – $5 area using this inverse H&S , and began to sell on the way up over $4.50.

.

Then after the run fulfilled (Topping candle), we had to look at a logical place that Vale may drop to. These were two ideas, if vale had in fact topped at that $4.87 high & reversal. We’d be looking at the $3.82 and $3.50 area for starters.

Vale almost hit the 50% retrace on March 10, and volume was lightening up. The 20sma was entering that $3.50 area.

March 14, selling was slowing up in that support area, and I mentioned that I started a position. I started small, because this ‘could’ still drop to the 50sma, but it was above support ( Yellow) .

VALE – Vale pulled right back to the $3.50 area as hoped for Tuesday and also on Fed Wednesday. It took off after the Fed Decision. I captured this chart at 3:30, but it closed even higher at $3.99. So you can see why that was a low risk entry. That doesnt mean that it will go straight up from here though.

REMINDER CHART – Notice how long the price lingered at the 50sma at the end of March? This may or may not go right back up to the highs. It could also play out in a consolidation manner as shown, time will tell. The entry is low risk, even during possible price swings.

These are 2 more examples from Thursdays report showing a lower risk area to enter a position. A ‘stop’ is placed below a reasonable support area.

CLF – I had been watching this one for re-entry too. Look what it did during the FED MTG.

CENX – That recent pull back to the 20sm offered a low risk entry with that reversal.

There were others pointed out too.

.

The FED Decision seems to be favorable for a continued run in Commodity stocks and they’ve presented a low risk opportunity (if you honor your stops). Many Metals stocks have pulled back and consolidated going into the Fed Mtg. Now they may be at a lower risk entry point. OIL moved higher after the Fed Decision too. We’ll see if some more of our Energy stocks that have been pulling back can also tack on some gains. If you didn’t buy the pullbacks in commodities yet, this may be your day. Happy trading!

.

~ALEX

Bonus Energy possibility (Caution, they are higher risk due to debt and lower oil prices. Due diligence is due.

LGCY 3-16 …Yes, it is still acting correctly consolidating that blast higher. I’d like to see a repeat of that orange box.

Well, the past several weeks have been excellent for trading Metals, Miners, and Energy, and whether you follow me in the Public area or the premium side, I hope you've had a chance to make some solid gains. I've already discussed in past public posts about chart set ups in Miners and Commodities like X, AKS, FCX, CLF, etc, so Lets take a look at the recent crazy but very lucrative trading set ups in Energy.

OIL & ENERGY - Why?

.

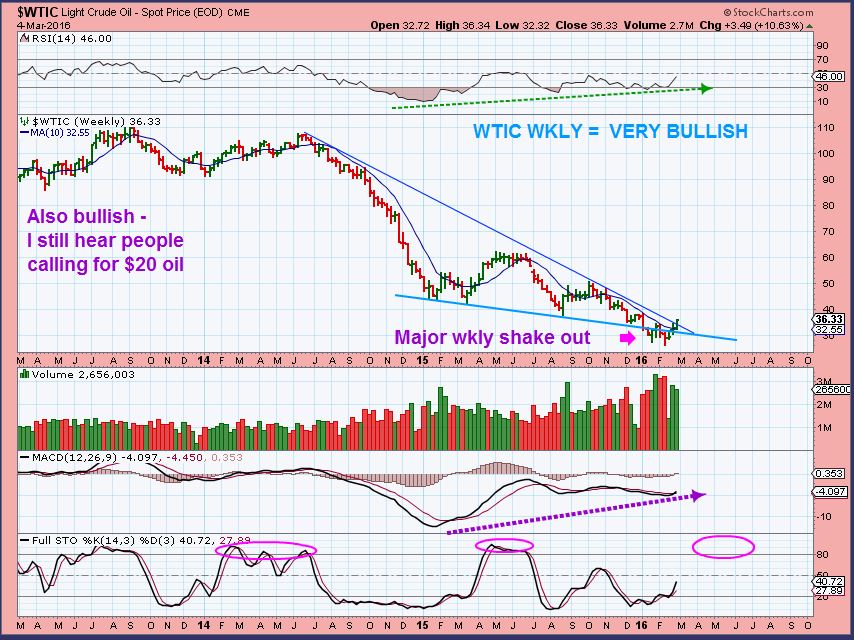

WTIC - As I pointed out in a public report weeks ago, I was looking for a possible bottom in Oil around $26.09 from this Nov Wkly chart.

WTIC WKLY - I believe Oil bottomed in a shake out type manner. Is it just a bounce? This chart looks quite Bullish.

Read More

Read More

Scroll to top

Look at The sea of Green in various Commodities after the Fed Decision was released.

Look at The sea of Green in various Commodities after the Fed Decision was released.