Archive for month: May, 2016

Goldman Sacks sees higher prices in Oil. Finally.

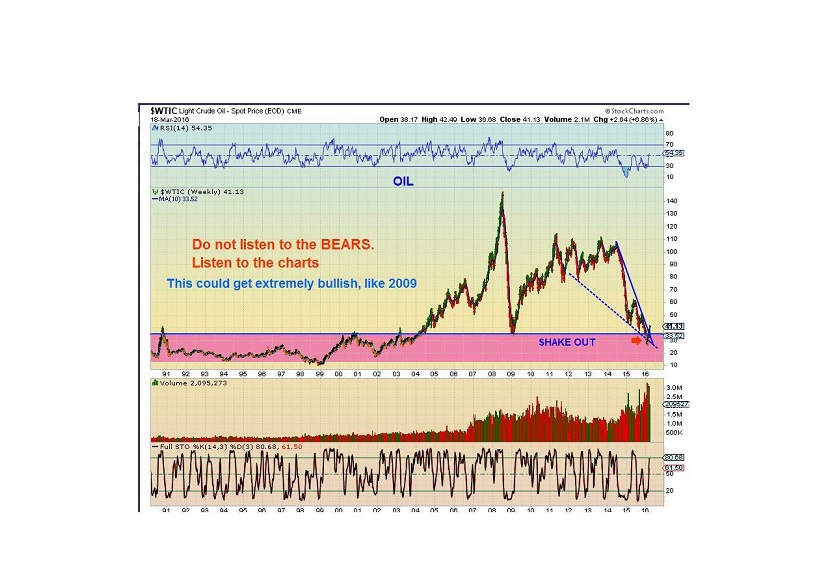

/in Public /by Alex - Chart FreakUsing charts like the one below, you may recall that I had been call for a low in Oil in early 2016 and snap back rally in Oil and Energy stocks. Since that time, many analysts still called for another price crash, and that includes Goldman Sachs . Is this important? It is if you missed some of the 100%, 200% 300% gains in some of the energy stocks.

Did you see the news today about Oil by Goldman today? This was the headline.

Read MoreMay 15 Weekend Report

/43 Comments/in Premium /by Alex - Chart FreakWhile looking at a variety of charts for the weekend report, I started to see things give us some mixed signals about he health of various sectors. With that in mind I wanted to do something just a little different for this report.

. Read MoreFriday The 13th ( Of May )

/55 Comments/in Premium /by Alex - Chart FreakThis is my "It's Friday and I dont usually do reports on Friday" report. Whenever Thursdays action raises questions that can't wait until the weekend, I do a Friday report.

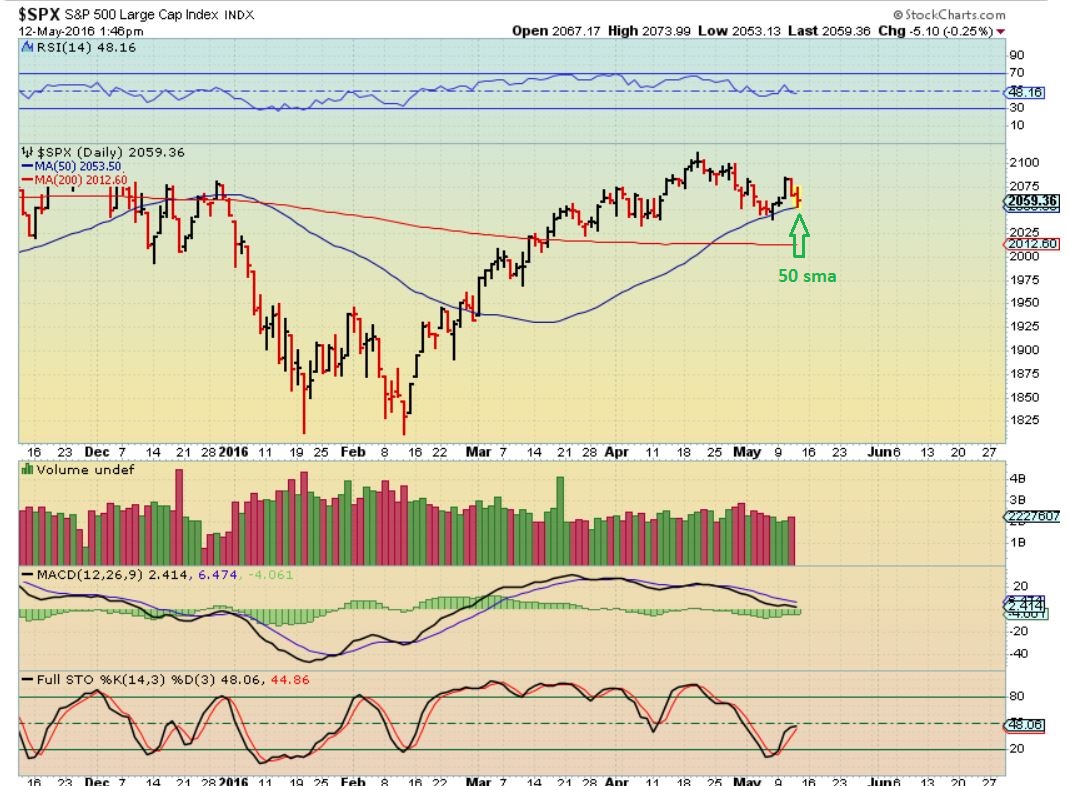

.SPX - This was yesterdays chart. We likely saw a DCL last Friday with the reversal at the 50sma. AS LONG AS THOSE LOWS HOLD, the DCL is in place. Even if it goes sideways for days above the dcl, like the red circle that I drew above the Jan DCL, nothing has changed.

SPX Thursday - Nothing has outwardly changed yet, but this is looking weak. Volume increased a bit, the MACD looks weak, and the hrly charts look weak. If this breaks down, that H&S measures a move down to the 200sma. Do I expect that?

Read More

Read MoreMAY 12 – Timing

/63 Comments/in Premium /by Alex - Chart FreakAfter a brief market review, I want to point out something that seems to be telling me that now is the time to act. Lets begin...

.SPX - Price was rejected at the upper trend line, and it dropped down to the 10sma. The Red Circle shows that shortly after prior DCLs, price did the same thing. A drop below the dcl would not be healthy, the first daily cycle would be extending way too far and I would be suspicious.

.

.

From here I'm going straight to OIL, NATTY, and The CRB...

. Read MoreIt Happens

/82 Comments/in Premium /by Alex - Chart FreakHave you ever been thrown off of a Bull? Maybe your stop was triggered only to see that stock turn and move higher. What can you do? We'll discuss that after a quick market review.

.SPX - This was my May 5th chart. I have been pointing out that the SPX ( And general markets) are due to rally.

SPX as of Tuesday - That is what we see happening as the markets were green for the past 3 days.

Read More

Read MoreTo Be Or Not To Be?

/85 Comments/in Premium /by Alex - Chart FreakThat is the question...

.

SPX - I'm Still expecting higher prices in the near term, with a DCL likely in place.

.

Read More

.

Read MoreMAY 8 Weekend Report

/126 Comments/in Premium /by Alex - Chart FreakWe will discuss the Theme Picture later in the report, lets get right into our market review...

.SPX - We are expecting and late for a DCL. The SPX tagged the 50sma and put in a small reversal candle. I believe that we are about to get a move higher.

That calls for a look at the bigger picture...

Read MoreMAY 5 – Perspective And Emotions

/88 Comments/in Premium /by Alex - Chart FreakOur perspective on certain things can affect our emotions. Isn't it true that how we view things often changes the way we feel about them? Especially if there are two sides to a story? 🙂 Well it can be that way with trading too. We can look at a long term bullish chart and see it as 'horrible' if it is pulling back below our buy point. The faces in the Theme picture above could very well be the many faces of trading, so I am going to discuss perspective and emotions.

.If I show you this stock and simply ask, " Is this chart Bullish or Bearish?" How do you answer?

.BULLISH, right? It has run up 300%, its in a channel of higher lows and higher highs, and has just pulled back from $14 to basically $11.50.

Perspective : I am being told that this is one dreadfully ugly chart. If you bought at $4, you may love it, but if you bought it at $12, $13, or even $14? It has been nothing but volatile.

.

So you see, it is a matter of perspective...

.That chart above is FCX, and anyone who bought it in the past week may not be as happy as those that bought it lower. Lets zoom in. Please read the chart.

Read More

Read MoreLight On The Horizon

/127 Comments/in Premium /by Alex - Chart FreakWe've seen some selling in the markets this week, are their brighter skies on the horizon? Yes, I believe there are. Lets take a look...

. Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine