I received a good number of emails where people said that they were “Going short for the final plunge in Gold below $1000!”. I’m not saying that that plunge wont come, but does the evidence point to last weeks break down being the signal to go short? Lets look at some charts and see what I wrote in my weekend report.

The USD Wkly looks strong and has weakened Gold, but will it break out & run or might it pause or even double top?

If this is a rising wedge, the dollar will stall (or fall) and Gold could pop. I wrote a few bullish and bearish points on the chart.

THE CRB – If the DOLLAR double tops, the CRB would likely bottom. It is at support and overdue for a 3 yr cycle low. This would imply that the Dollar will top.

Lets talk about what happened in GOLD last week.

EDIT: This is from the weekend report unless I note otherwise

GOLD – Friday New lows. Please note that Silver & Miners are not following. They usually lead the way down. With that I have to wonder if this is a final shake out similar to that quick drop in July? Many have gone short & are bearish now again.

UPDATE : Monday Gold recovered while the USD went higher.

SILVER– Silver held recent Nov 23 lows as it sold off and reversed higher Friday. In fact, the MACD is trying to cross upward at these lows. I would be nervous “Shorting Silver” here. It didn’t drop to new lows with Gold and the MACD is gaining traction.

AG – Is a silver stock. This looks strong for what happened this past week.

SSRI – A Silver stock that is holding up on the 10sma despite recent selling.

GDX – I drew this mid day Friday to show that GOLD broke to new lows and was staying down there, but Miners held their Sept 11 lows, and also didnt break the recent November lows from a week ago. HMMM

UPDATE AS OF MONDAY : So look at components of GDX. Is this a sign that Gold is about to plunge after breaking to new lows? or does this look like smart money could be accumulating Miners? Should you short this?

NEM – Gold broke down to new lows, NEM looks strong.

ABX – Gold broke to new lows, ABX is holding up well.

SA – Another Gold stock that is ignoring Golds drop. This set up was actually being pointed out as a buy at the 50sma for the past week.

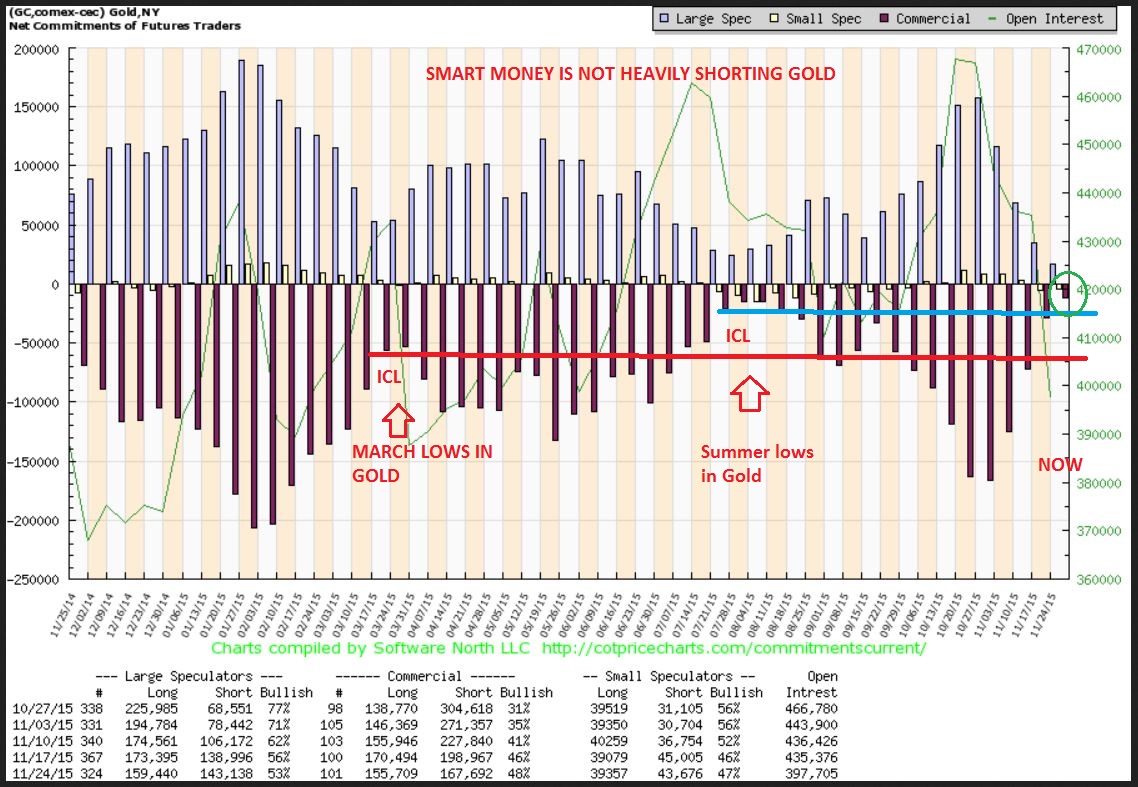

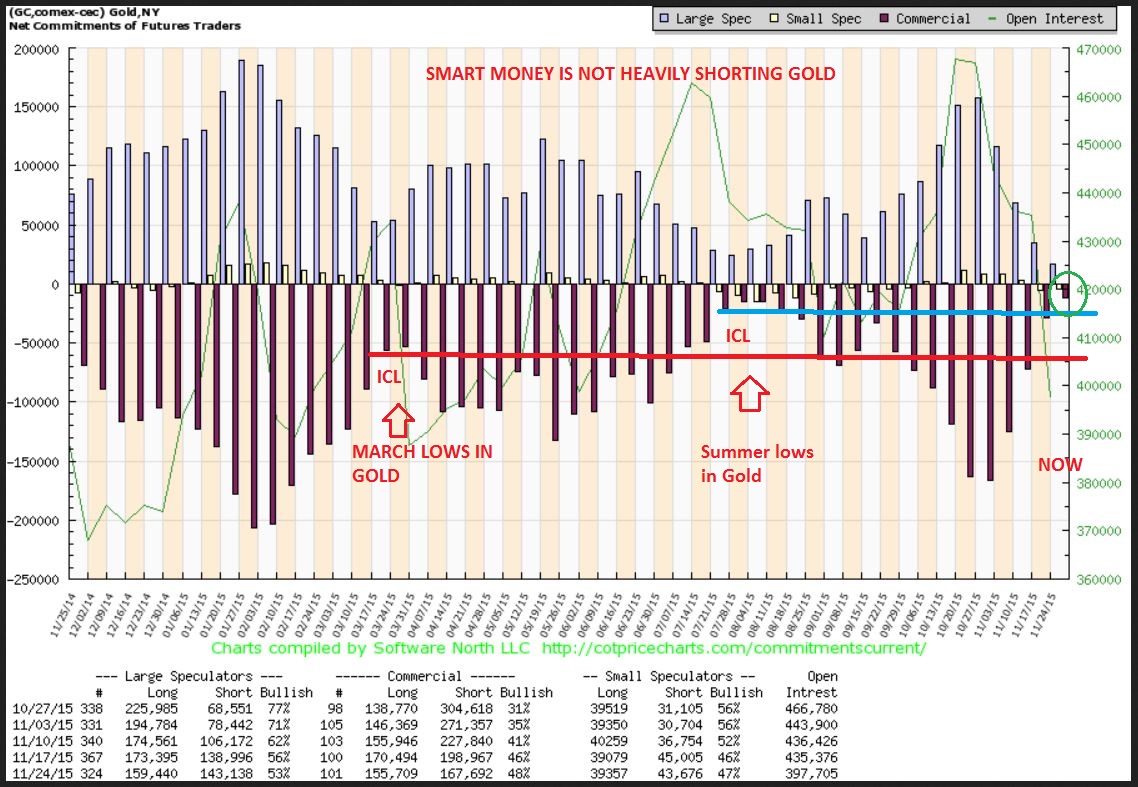

Finally, this is the C.O.T. released Monday. It shows that SMARTMONEY has bailed out on their shorts for Gold. They are NOT heavily short Gold. The prior lows for GOLD are pointed out, and smart money shorts are less now than they were at the prior lows. Should you be shorting when SMARTMONEY is not?

GOLD broke down to new lows Friday and I read on stocktwits and in other areas that many people were now shorting. Silver and Miners didn’t follow as shown above. In fact, some Silver & Gold Mining stocks are even holding their 10sma as of Friday. The C.O.T. shows that Smart money was rapidly closing their short positions. In my weekend report I was pointing out that by leaving emotions about that break down aside, the evidence was bullish too. Monday we saw GOLD recover and Miners move higher, while the dollar was green too. If you are short, you must make sure you have stops in place. I believe we could Rally or have a good bounce at least.

Thank you for stopping by and reading along at chartfreak. If this is the type of analysis that may help you in your trading, why not sign up for a month and try it out. It is only $37.95 for 1 month. You can also sign up for free email alerts to let you know when these free posts are released. Again thanks for being here and happy trading!

~ALEX

Did You Short The Gold Break Down?

Leaders And Laggers

Leaders And Laggers

Scroll to top

Continued to see divergence btw energy plays and USO as they held after oil have up morning gains. Energy sector ending day near top of leader board on otherwise down day. What does that mean for oil? Not sure, but if it ever puts in a meaningful recovery, energy should really outperform.

Wonderful set of charts; excellent eye! Thanks so much!

Thank You 4eyes – Hope it helps 🙂

Great report, I noticed that the miners weren’t responding to the lows gold put in so I bought first majestic last week because it was responding well to the silver price.

Hi John,

Yeah, I like the way First Majestic was acting too. Some of the miners look to already have bottomed longer term too. Refresh to Check out this chart of NG and the chart of SA is a sweet %-Gainer.

Thanks for stopping by.